Discover the unparalleled capabilities of the Trader Workstation (TWS), a cornerstone for ambitious traders and investors. Crafted with expertise by market makers, TWS empowers its users to explore and interact with over 150 global markets. Dive into a universe where stocks, options, futures, currencies, bonds, and funds amalgamate on a single, unified platform. Ready to embark on your TWS journey? Choose a version, download, and commence your trading adventure. For those who favor manual updates, the offline TWS version is available, though it requires periodic manual updating.

In essence, the Trader Workstation is more than just a platform; it's a comprehensive ecosystem designed to elevate your trading experience. Whether you're an amateur or a seasoned professional, TWS offers tools and insights that cater to all your trading needs.

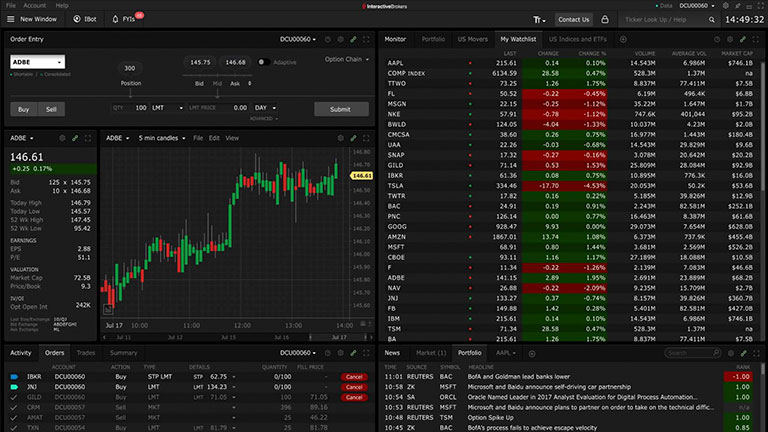

The Distinctive TWS Mosaic Interface

The Mosaic interface is synonymous with instinctive usage right from the first interaction. Features include:

- Unified Trading: All essential trading tools, from order management to live quoting, are encapsulated in one streamlined window.

- Portfolio Insights: A comprehensive glance at your account's health and a meticulous breakdown of your position's details.

- Dynamic Order Management: From formulating to transmitting orders, every action is instantaneous. The system even allows the creation of multifaceted orders including bracket, stop limit, and more.

- Adaptable Market Scanners & Watchlists: Personalize your view of the market, and use visual tools to easily identify trends.

- Informed Decision Making: Stay updated with real-time news from reputable sources and enhance your platform with prime research content.

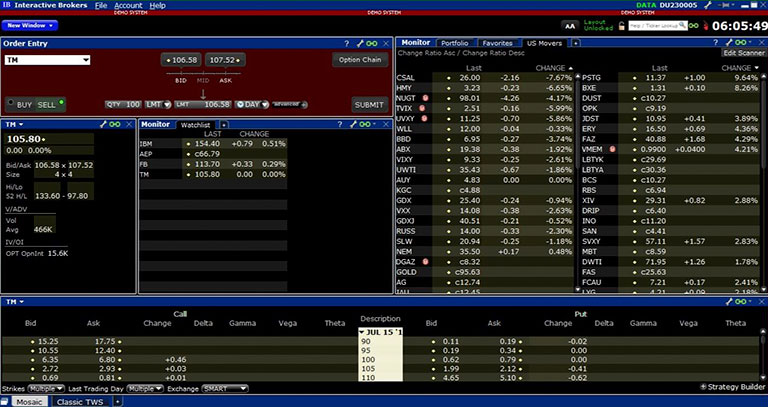

Classic TWS

A Touch of Tradition for Advanced Needs While Mosaic caters to modernity, Classic TWS echoes tradition with its quick click order functionalities. Advanced tools and algorithms are always at hand for those seeking a deeper dive.

A Repository of Essential Information

Stay a step ahead with access to:

- News Services: Fresh off the press updates from giants like Reuters, Dow Jones, and flyonthewall.com.

- Quality Analyst Research: Dive deep with insights from Morningstar, Zacks, and many more.

- Real-time Data: Get up-to-speed information on various exchanges, event calendars, and company specifics.

Real-Time Monitoring and Account Management

Keep an eagle eye on your trading voyage:

- Instantaneous Account View: A tailor-made window presenting crucial account details.

- Margin Mastery: Understand your margin prerequisites and dodge potential liquidations.

- Activity Log: A daily digest of your trading actions.

- Watchlists & Alerts: Personalized monitoring and real-time notifications for vital market movements.

Diverse Order Types and Advanced Algorithms

With over 100 order types and algorithms, TWS offers tools that facilitate price improvement, market timing, privacy, and efficient execution.

Pioneering Risk Management

Harness TWS's state-of-the-art risk-assessment technology to navigate dynamic markets effectively. Key tools include:

- Risk Navigator: An innovative platform that offers an in-depth risk analysis across various global asset classes.

- Model Navigator: Adjust pricing presumptions seamlessly with this advanced pricing tool.

- Option Analytics: Grasp the nuances of option pricing through comprehensive risk dimension metrics.

Practice Makes Perfect: Paper Trading Feature

Hone your trading strategies in TWS's simulated environment. It's a risk-free arena that mirrors real market conditions, giving you:

- Real-time Tool Access: Engage with dynamic charts, market depth, risk analytics, and more.

- Strategy Testing: Explore new products, exchanges, order types, and get daily account statements.

- API Testing: Validate your IB API trading setups in this simulated realm.

Trader Workstation, commonly known as TWS, is a high-performance trading platform primarily designed for active traders and institutional investors. Developed and managed by Interactive Brokers, TWS provides a robust environment for trading multiple assets in real-time across global markets.

Key Features:

- Diverse Asset Classes: TWS users can trade a variety of instruments including stocks, options, futures, currencies, bonds, and funds, making it a one-stop solution for diversified trading.

- Global Reach: The platform connects its users to over 150 markets worldwide, providing a truly global trading experience.

- Integrated Tools: From portfolio management to technical analysis, TWS boasts an array of integrated tools. This includes real-time charting, technical analysis tools, market scanners, and research utilities.

- Advanced Order Management: With support for over 100 order types and specialized algorithms, TWS facilitates complex trading strategies, risk management, and efficient order execution.

- Customizable Workspace: Users can tailor the TWS interface to their preferences, be it through the intuitive Mosaic interface or the traditional Classic TWS. They can also link windows, create multiple watchlists, and set personalized alerts.

- Real-time Monitoring: Traders can actively monitor their positions, account balances, margin requirements, and more, allowing for swift decision-making in volatile markets.

- Educational and Simulated Trading: The platform comes with a Paper Trading feature, allowing users to test strategies and get familiar with the interface without risking real capital.

- Comprehensive Risk Management: Tools like the Risk Navigator provide an in-depth risk analysis, helping traders understand and manage their exposure across assets and markets.

- Research and News Integration: TWS offers its users access to premier news services, research, and financial information from globally recognized providers.

System Requirements and Accessibility:

- Desktop Client: TWS offers a downloadable software client for both Windows and macOS, ensuring smooth performance and a comprehensive set of features.

- Web and Mobile: For traders on the move, there's a web version and mobile applications available for both Android and iOS. These versions offer the core functionalities of TWS, tailored to a streamlined interface for on-the-go access.

- API Integration: For those looking to automate their trading or integrate third-party tools, TWS provides a robust API (Application Program Interface).

Security

TWS, being a product of Interactive Brokers, incorporates high-standard security protocols. This includes secure login systems, data encryption, and continuous monitoring against potential threats. Trader Workstation (TWS) stands out as a comprehensive, versatile, and powerful trading platform tailored for professional traders and institutional investors. Whether one is looking for diverse asset trading, advanced tools, or global market access, TWS offers a solution that aims to enhance and optimize the trading experience.

Trader Workstation (TWS) Platform: Advantages and Disadvantages

Advantages:

- Robust Asset Offering: TWS offers a vast range of assets from stocks, options, futures, currencies, bonds, to funds, catering to diversified trading strategies and investment portfolios.

- Global Market Access: With connectivity to over 150 markets worldwide, TWS provides a truly global trading platform for its users.

- Advanced Trading Tools: The platform supports over 100 order types and algorithms, which can cater to sophisticated trading strategies and ensure efficient order execution.

- Customizability: Whether it's the Mosaic interface for a modern touch or Classic TWS for a traditional feel, users can customize the platform according to their preferences, including creating multiple watchlists, linking windows, and setting up personalized alerts.

- Integrated Research & News: TWS seamlessly integrates with premium news and research providers like Reuters, Dow Jones, and Morningstar, ensuring traders are always informed.

- Simulated Trading Environment: The Paper Trading feature is invaluable for beginners and seasoned traders alike, allowing for risk-free strategy testing and platform familiarization.

- Comprehensive Risk Management: Tools such as the Risk Navigator offer an in-depth risk analysis, ensuring traders have a clear picture of their exposure.

- API Integration: For algorithmic traders and those looking to integrate third-party tools, TWS's robust API is a significant advantage.

- Security: High-end security measures, including secure login systems, data encryption, and constant threat monitoring, ensure user data and funds remain protected.

Disadvantages:

- Complex Interface for Beginners: While TWS offers a range of advanced tools, its interface can be overwhelming for new traders. The learning curve can be steep for those unfamiliar with professional trading platforms.

- System Requirements: The desktop version of TWS, given its comprehensive features, might require a modern computer for optimal performance. This can be a barrier for users with older machines.

- Occasional Software Glitches: As with any complex software, TWS isn't immune to occasional bugs or glitches, which might affect trading activities.

- Updates & Changes: Regular software updates, while necessary for security and adding features, might change familiar functionalities or introduce new ones that users have to adapt to.

- Costs Associated with Premium Features: While TWS itself offers a robust set of tools, some premium features, especially research and news from tier-one providers, might come at an additional cost.

- Mobile Version Limitations: While the mobile version of TWS provides core functionalities, it might not offer the full range of features available on the desktop version, potentially limiting on-the-go trading activities.

Conclusion

Trader Workstation (TWS) is undoubtedly a powerhouse in the world of trading platforms, designed with professional traders and institutional investors in mind. While its strengths lie in its comprehensive tools, global access, and customizability, newer traders might find it a bit daunting initially. As with any platform, it's essential for users to weigh the advantages against the disadvantages to determine if it aligns with their trading needs and style.

Related Materials

In the ever-evolving world of forex trading, ZuluTrade emerged as a beacon of collaboration, merging the expertise of professional traders with the trading ambitions of individuals globally. Founded in 2006 by Leon Yohai, ZuluTrade has redefined forex trading, giving it a social and collaborative edge.

While the IG Trading Platform boasts several significant advantages, especially for experienced traders, potential users should be aware of its drawbacks. It's essential for traders to assess their needs, trading style, and budget before committing to any platform.

SaxoTraderGO is one of the signature platforms offered by Saxo Bank, a leading player in the online trading and investment sector. Saxo Bank has been a dominant figure in the trading and investment landscape for over 30 years...

TradingView stands as an unparalleled beacon in the trading world, acting as both an advanced charting platform and an expansive global social network for traders and investors. With over 50 million users, it's revolutionized how traders interact, analyze, and execute their strategies.

Thinkorswim is a trading platform of institutional caliber primarily designed for day trading. With cutting-edge systems for monitoring and analyzing investment assets, options, and derivatives, Thinkorswim stands out as an efficient, comprehensive, and powerful financial tool...

cTrader stands out as a prominent online trading platform that took its initial steps in 2010 under the aegis of Spotware. With the surge in online foreign exchange brokers' activities, platforms like cTrader play an instrumental role in connecting traders with the global market, ensuring seamless trading operations.

MetaTrader 4, commonly abbreviated as MT4, stands as a stalwart in the realm of forex trading platforms, offering robust tools for financial market analysis and the execution of trading strategies through Expert Advisors (EAs). It's not just limited to a desktop experience; with MT4, the world of forex trading is literally at your fingertips through its powerful mobile trading capabilities.

NinjaTrader stands out as a favored trading platform for novices and seasoned traders alike, spanning markets such as forex, futures, and stocks. In this detailed analysis, we'll delve into its primary functionalities, trading interfaces, instruments, and the overall user journey that NinjaTrader provides...

Emerging from the shadows of the iconic MetaTrader 4 (MT4), MetaTrader 5 (MT5) introduces itself as a next-generation trading platform. This evolution is designed to meet the ever-expanding demands of modern traders. While MT4 set the industry standard, MT5 pushes the boundaries further, expanding its reach to cater to diverse asset classes, fortifying its charting prowess, and refining its technical analysis tools.

Trusted Forex Brokers

| Broker | Review | Rating | |

|---|---|---|---|

| 1 | HF Markets | ||

| 2 | NordFX | ||

| 3 | Octa | ||

| 4 | FXCM | ||

| 5 | Interactive Brokers | ||

| 6 | ActivTrades | ||

| 7 | FXTM | ||

| 8 | easyMarkets | ||

| 9 | HYCM | ||

| 10 | SaxoBank | ||

| 11 | FxPro | ||

| 12 | Moneta Markets | ||

| 13 | XM | ||

| 14 | FOREX.com | ||

| 15 | Admirals | ||

| 16 | eToro | ||

| 17 | FIBO Group | ||

| 18 | Pepperstone | ||

| 19 | PrimeXBT | ||

| 20 | IronFX | ||

| 21 | Forex4you | ||

| 22 | InstaForex | ||

| 23 | INGOT Brokers | ||

| 24 | Swissquote Bank | ||

| 25 | Oanda |