Swing trading, by nature, is a style designed to capitalize on price "swings" or movements over a short-to-medium term. When applied to the forex market – known for its volatility and 24-hour trading cycle – swing trading becomes an intriguing strategy. Let’s delve deep into its nuances, strengths, potential pitfalls, and best practices. The anatomy of swing forex trading is deeply rooted in technical analysis. Forex swing traders employ a myriad of tools – candlestick patterns, moving averages, momentum indicators like the RSI or MACD, and Fibonacci retracement levels – to decipher potential entry and exit points. These tools help in identifying when a currency pair is likely to reverse its direction, signaling an optimal point of trade entry, and when the momentum might be waning, suggesting a possible exit or take-profit point.

What is Swing Trading?

Yet, the world of forex is uniquely impacted by macroeconomic developments, central bank decisions, and geopolitical events. Consequently, while technical analysis might form the strategy's backbone, an astute swing trader often marries it with elements of fundamental analysis. Interest rate decisions, employment figures, or even unexpected news like geopolitical tensions can act as catalysts, accelerating or reversing currency swings. Being attuned to such developments enriches a swing trader's perspective and refines decision-making. Swing trading in forex aims to exploit the oscillations or "swings" of currency pairs. Traders typically hold positions for several days to several weeks, trying to capture the bulk of a significant move rather than its minor day-to-day fluctuations.

Key Techniques and Indicators

- Technical Analysis: Chart patterns (e.g., triangles, flags, and head and shoulders) offer clues about upcoming price movements.

- Moving Averages: The crossing of short-term and long-term moving averages can signal potential buy or sell opportunities.

- Momentum Indicators: Tools like the RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) help gauge the strength of a trend.

- Support and Resistance: Identifying key price levels where a currency pair historically had trouble moving below (support) or above (resistance) provides potential entry and exit points.

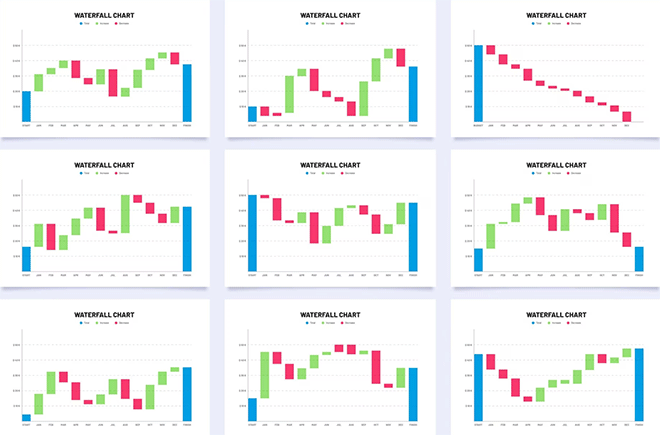

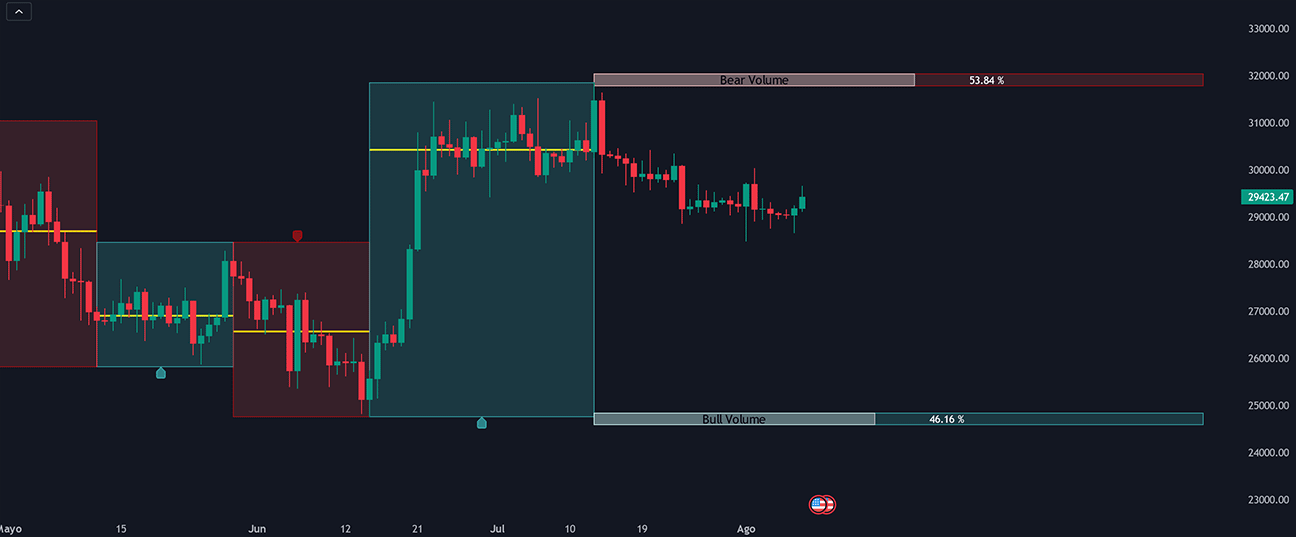

Swing Ranges Indicator

Strengths of Swing Trading in Forex

- Time-Efficiency: Unlike day trading, swing trading doesn’t require constant market monitoring. Once positions are set with appropriate stop losses and take profits, they can be left to play out.

- Profit Potential: Swing traders can capture larger price moves than day traders, potentially leading to greater profits per trade.

- Reduced Noise: By focusing on more extended periods, swing traders can ignore much of the market “noise” seen in intraday trading.

Challenges and Pitfalls

- Overnight Risk: Holding positions for days exposes traders to the risk of significant price gaps between market close and open.

- Economic Announcements: Unplanned news releases or economic updates can disrupt a well-thought-out swing trading strategy.

- Higher Costs: Keeping positions open for several days might incur rollover or swap fees, impacting profitability.

The Interplay with Fundamental Analysis

While swing trading is predominantly technical, it's wise to incorporate fundamental analysis. Economic calendars, which highlight significant upcoming events, are vital. A sudden interest rate change or geopolitical event can drastically affect currency prices, potentially invalidating technical setups.

Risk Management

Proper risk management is crucial. Swing traders typically:

- Use stop losses to protect from significant adverse movements.

- Determine risk-reward ratios (e.g., risking $1 to potentially make $3) before entering a trade.

- Only risk a small percentage of their trading capital on any single trade.

Tips for Success

- Stay Updated: While it's a technical strategy, being aware of major global events can save from unexpected shocks.

- Continuous Learning: The forex market evolves. Periodic review and adjustment of the swing trading strategy are essential.

- Emotional Control: Forex swing trading requires patience to let trades play out and discipline to stick to one’s strategy.

Swing trading in forex is a balance between the fast-paced world of day trading and the patience-testing realm of long-term strategies. Its focus on medium-term movements allows for potentially significant profits, but like all trading strategies, it requires dedication, continuous learning, and strong risk management. With the right approach and mindset, swing trading can be a powerful tool in a forex trader’s arsenal.

However, swing forex trading, with all its potential, is not without pitfalls. The forex market's leverage, while amplifying potential gains, can similarly magnify losses. Hence, disciplined risk management, employing techniques like stop-loss orders or only risking a small fraction of one's trading capital per trade, becomes paramount. Moreover, the necessity to hold positions overnight or over multiple days exposes traders to swap or rollover fees, which need to be factored into profitability calculations.

In sum, swing forex trading offers a compelling vantage point to observe and interact with the currency market's ebb and flow. It demands a harmonious blend of technical prowess, fundamental awareness, patience, and discipline. For those seeking to harness the cyclical nature of forex without being chained to their screens or waiting endlessly for long-term trends to materialize, swing trading presents an enticing middle path. A journey into this strategy offers not just potential financial rewards but also a deeper appreciation of the myriad forces that move the world's most liquid market.

Related Materials

The concept of hedging may conjure images of meticulous garden maintenance, but in the financial landscape, it represents a pivotal strategy for safeguarding investments.

Navigating the intricacies of forex trading can often feel like navigating a labyrinth for beginners. The key to unlocking success within this maze lies in equipping oneself with robust forex trading strategies and techniques. As you venture into the world's largest financial market, having a reliable roadmap in the form of a trading strategy can be a game-changer.

Forex trading, with its high liquidity and rapid price movements, offers traders numerous opportunities. However, it is crucial to have the right strategy to harness these opportunities effectively. Here, we explore the top 5 most profitable forex trading strategies, delving into their advantages and disadvantages...

Scalping is a popular and fast-paced trading strategy used primarily in the Forex market. The primary objective for scalpers is to capture small price movements with the intention of securing quick profits...

The Trend Following strategy is a widely practiced approach in the world of Forex trading. At its core, the philosophy behind it is simple: Markets tend to move in trends, and the goal is to capture profits from these movements. Traders adopting this strategy will aim to enter the market in the direction of the prevailing trend, seeking to ride the momentum for as long as the trend lasts.

In the vast tapestry of Forex trading methodologies, position trading occupies a distinct niche. Rather than riding the short-term waves and troughs, position traders set their sights on the long-term, capitalizing on extended market movements...

Breakout Trading Strategy capitalizes on moments when an asset breaks beyond established resistance or support levels. This movement could signal the start of significant price movements, and traders aim to enter the market right as the breakout happens, hoping to profit from the subsequent trend...

Trusted Forex Brokers

| Broker | Review | Rating | |

|---|---|---|---|

| 1 | HF Markets | ||

| 2 | NordFX | ||

| 3 | Octa | ||

| 4 | FXCM | ||

| 5 | Interactive Brokers | ||

| 6 | ActivTrades | ||

| 7 | FXTM | ||

| 8 | easyMarkets | ||

| 9 | HYCM | ||

| 10 | SaxoBank | ||

| 11 | FxPro | ||

| 12 | Moneta Markets | ||

| 13 | XM | ||

| 14 | FOREX.com | ||

| 15 | Admirals | ||

| 16 | eToro | ||

| 17 | FIBO Group | ||

| 18 | Pepperstone | ||

| 19 | PrimeXBT | ||

| 20 | IronFX | ||

| 21 | Forex4you | ||

| 22 | InstaForex | ||

| 23 | INGOT Brokers | ||

| 24 | Swissquote Bank | ||

| 25 | Oanda |