In the intricate tapestry of Forex trading strategies, trend following emerges as one of the most time-tested and universally respected approaches. Often contrasted with the rapid-fire techniques like scalping, trend following boasts a simplicity that has charmed novice traders and veterans alike. It rests upon the foundational belief that "the trend is your friend", a maxim that, despite its simplicity, encapsulates a deep market wisdom. Trend following is, as the name suggests, a trading methodology predicated on the idea that financial markets move in discernible, sustained directions over time, known as trends. These trends can be upward (bullish), downward (bearish), or even sideways, and a trend follower aims to identify these directions and then take positions that align with the current trend. It's a strategy that demands patience and discipline, requiring traders to ignore the myriad of market noise and focus on more prolonged movements.

One might wonder, why follow the trend? The rationale behind this strategy is twofold. Firstly, financial markets are inherently influenced by a vast array of factors, ranging from geopolitical events, economic data releases, to shifts in market sentiment. While predicting the precise reaction to these variables can be daunting, recognizing a broader trend that encapsulates their cumulative effect becomes feasible. Secondly, trends, once established, tend to perpetuate due to factors like herd behavior and self-fulfilling prophecies. Thus, betting with the trend rather than against it often enhances the probability of trading success.

How Trend Following Strategy Works

-

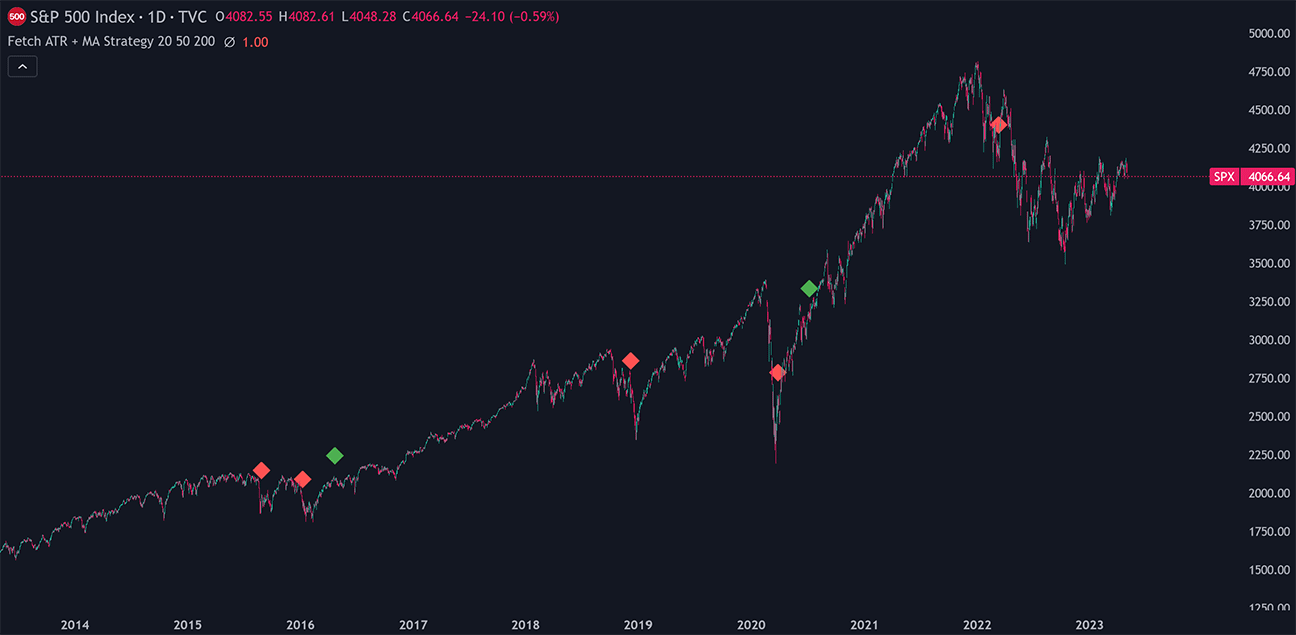

Identifying the Trend: This is the crucial first step. A common method is using moving averages. For instance, if a short-term moving average (like the 50-day MA) crosses above a long-term moving average (like the 200-day MA), it could signal the start of an upward trend (and vice versa for a downward trend).

-

Entry & Exit Points: After identifying a trend, traders will determine when to enter and when to exit a trade. They often set stop-loss points to exit the position if the trend shows signs of reversing.

-

Riding the Trend: The objective is to remain in the trade as long as indicators suggest the trend is ongoing.

Trend Following Indicator

Key Tools and Indicators

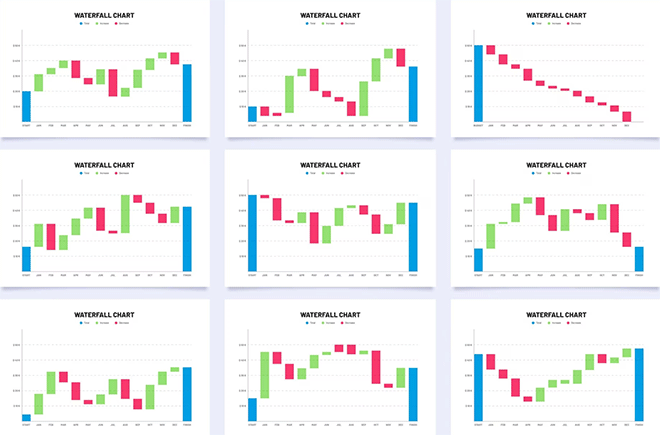

The tools of a trend follower are diverse yet straightforward. Chart patterns, like channels, triangles, and flags, help traders visualize and predict potential trend continuations or reversals. Meanwhile, moving averages, a staple in the trend follower's toolkit, smooth out price data to create a single flowing line, which makes it easier to identify the direction of the trend. Another popular tool is the Moving Average Convergence Divergence (MACD), which can provide insights into trend strength and potential reversals.

-

Moving Averages (MA): As mentioned, MAs, especially the 50-day and 200-day, are popular. They smooth out price data to help identify the direction of the trend.

-

Relative Strength Index (RSI): This momentum oscillator can help traders understand if a currency pair is overbought or oversold, which can indicate potential trend strength or exhaustion.

-

Average True Range (ATR): This tool can provide insights into the volatility of a currency pair, aiding in setting appropriate stop-loss levels.

Advantages of Trend Following Strategy

-

Profit Potential: In strong trending markets, this strategy can deliver substantial profits, especially if a trader can enter near the beginning of a trend and exit near its conclusion.

-

Simplicity: The concept of trend following is intuitive and easy to understand, even for beginner traders.

-

Flexibility: It can be applied across various time frames and markets.

Disadvantages of Trend Following Strategy

-

Drawdowns: Trends can be lengthy, leading to significant drawdowns before the trend reverses and profits materialize.

-

Late Entries: As the strategy requires confirmation of a trend, traders might miss out on the initial phase of a move.

-

False Signals: In range-bound or consolidating markets, trend-following tools can produce numerous false signals, leading to potential losses.

Tips for Successful Trend Following

-

Risk Management: Always use stop-losses and never risk more than a small percentage of your trading capital on a single trade.

-

Patience: Be prepared to weather the storm during drawdown periods, and avoid the temptation to jump ship too early.

-

Avoid Overfitting: While it’s essential to adapt, avoid tweaking your strategy too much based on short-term results.

The Trend Following strategy, while not without its challenges, remains a favored approach among many Forex traders. Its fundamental principle - that markets move in trends - is timeless. With the right tools, patience, and a robust risk management plan, trend following can be a profitable venture in the dynamic world of Forex trading.

By design, trend following strategies will always be slightly late to the party, entering after a trend has established and exiting once it has reversed. This lag can result in missed profits at the beginning and end of trends. Additionally, during periods when the market oscillates without a clear trend, the strategy can yield false signals, leading to potential losses. Despite these challenges, trend following's enduring appeal lies in its universality. It can be applied across different time frames, from the daily to the monthly, and is versatile across various asset classes, be it currencies, commodities, or equities. For those new to trading, it offers an approachable entry point, devoid of the complexities of some other strategies. And for market veterans, its reliance on robust principles ensures it remains a core component of their trading arsenal.

In conclusion, trend following stands as a testament to the idea that in trading, as perhaps in life, simplicity can often outshine complexity. In a market inundated with data, news, and opinions, the calm resolve of a trend follower - to see the forest for the trees and ride the overarching momentum - remains a beacon for many navigating the turbulent seas of Forex trading.

Related Materials

The concept of hedging may conjure images of meticulous garden maintenance, but in the financial landscape, it represents a pivotal strategy for safeguarding investments.

Navigating the intricacies of forex trading can often feel like navigating a labyrinth for beginners. The key to unlocking success within this maze lies in equipping oneself with robust forex trading strategies and techniques. As you venture into the world's largest financial market, having a reliable roadmap in the form of a trading strategy can be a game-changer.

Forex trading, with its high liquidity and rapid price movements, offers traders numerous opportunities. However, it is crucial to have the right strategy to harness these opportunities effectively. Here, we explore the top 5 most profitable forex trading strategies, delving into their advantages and disadvantages...

The anatomy of swing forex trading is deeply rooted in technical analysis. Forex swing traders employ a myriad of tools candlestick patterns, moving averages, momentum indicators like the RSI or MACD, and Fibonacci retracement levels to decipher potential entry and exit points.

Scalping is a popular and fast-paced trading strategy used primarily in the Forex market. The primary objective for scalpers is to capture small price movements with the intention of securing quick profits...

In the vast tapestry of Forex trading methodologies, position trading occupies a distinct niche. Rather than riding the short-term waves and troughs, position traders set their sights on the long-term, capitalizing on extended market movements...

Breakout Trading Strategy capitalizes on moments when an asset breaks beyond established resistance or support levels. This movement could signal the start of significant price movements, and traders aim to enter the market right as the breakout happens, hoping to profit from the subsequent trend...

Trusted Forex Brokers

| Broker | Review | Rating | |

|---|---|---|---|

| 1 | HF Markets | ||

| 2 | NordFX | ||

| 3 | Octa | ||

| 4 | FXCM | ||

| 5 | Interactive Brokers | ||

| 6 | ActivTrades | ||

| 7 | FXTM | ||

| 8 | easyMarkets | ||

| 9 | HYCM | ||

| 10 | SaxoBank | ||

| 11 | FxPro | ||

| 12 | Moneta Markets | ||

| 13 | XM | ||

| 14 | FOREX.com | ||

| 15 | Admirals | ||

| 16 | eToro | ||

| 17 | FIBO Group | ||

| 18 | Pepperstone | ||

| 19 | PrimeXBT | ||

| 20 | IronFX | ||

| 21 | Forex4you | ||

| 22 | InstaForex | ||

| 23 | INGOT Brokers | ||

| 24 | Swissquote Bank | ||

| 25 | Oanda |