In the vast ocean of Forex trading strategies, breakout trading stands out as a popular and effective approach for many traders, both newbies and veterans alike. It capitalizes on moments when an asset breaks beyond established resistance or support levels. This movement could signal the start of significant price movements, and traders aim to enter the market right as the breakout happens, hoping to profit from the subsequent trend. Let's delve deeper into the nature, mechanics, advantages, and potential pitfalls of the breakout trading strategy in the Forex market.

At its essence, breakout trading revolves around the idea that once a price surpasses a particular resistance (or falls below a specific support), it tends to continue in that direction. These resistance and support levels could be historical price levels, chart patterns, or other technical indicators. A 'breakout' signifies a potential shift in market sentiment.

Identifying Breakout Opportunities

-

Support and Resistance Levels: These are horizontal lines drawn on a price chart, indicating where the price has previously had difficulty moving above (resistance) or below (support).

-

Chart Patterns: Some patterns like triangles, flags, and head & shoulders can indicate potential breakouts. For instance, an ascending triangle often leads to a bullish breakout.

-

Moving Averages: A popular tool, especially the 50-day or 200-day moving averages. When the price moves above these averages, it might signal a breakout.

-

Volume: A significant increase in trading volume can validate a breakout, showing strong interest from traders at the breakout level.

Entry and Exit Points

-

Entry: Once you've identified a potential breakout, the next step is to determine an entry point. This could be as soon as the price breaks the resistance or support level or waiting for the price to close above/below these levels to confirm the breakout.

-

Exit: Setting a take-profit (TP) and stop-loss (SL) is crucial. A common approach is to set the TP at the next resistance level (for long positions) or support level (for short positions). The SL might be set just below the broken resistance or above the broken support to limit potential losses.

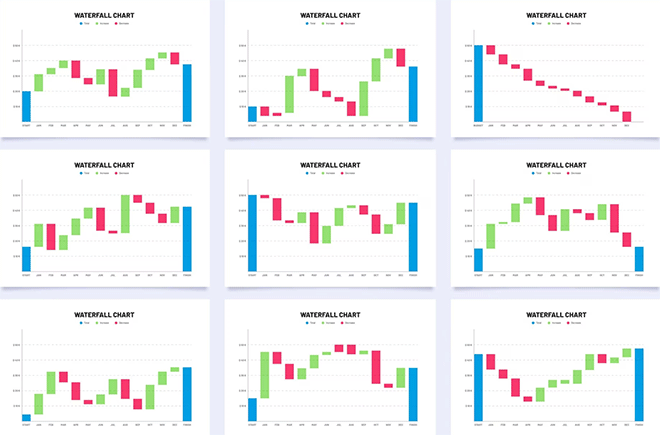

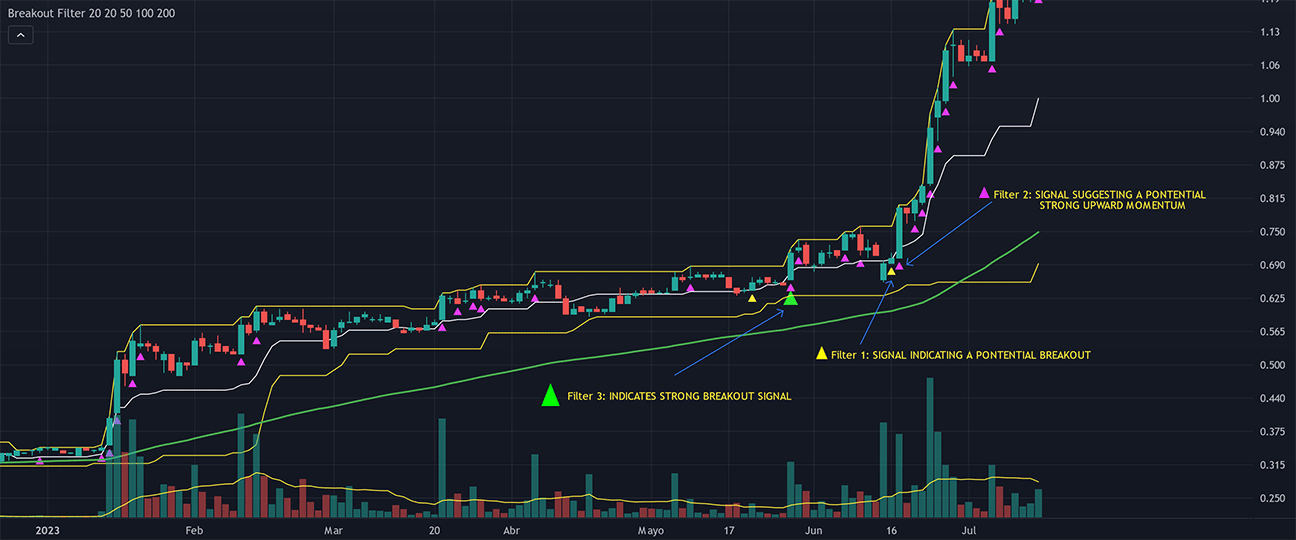

Breakout Filter Indicator

Not all breakouts result in new trends. Sometimes, the price might break a resistance or support level only to revert back. This scenario is called a 'false breakout' and is one of the primary challenges in breakout trading. To mitigate this:

-

Wait for Confirmation: Rather than entering immediately, wait for the price to close above/below the breakout level, or look for other confirming indicators.

-

Use Tight Stop-Losses: Setting a tight stop-loss can minimize potential losses from false breakouts.

Why Do Breakouts Happen?

- Economic Announcements: Major economic news or announcements can cause sharp price movements. For example, a sudden interest rate change by a central bank can trigger a breakout.

- Market Sentiment: If traders collectively feel bullish or bearish about a particular currency or asset, it can lead to a breakout.

- Technical Factors: Often, breakouts occur due to chart patterns like triangles, head & shoulders, or flags, which indicate potential price movements.

Advantages of Breakout Trading

-

Clear Strategy: It provides a clear plan regarding entry, exit, TP, and SL.

-

High Profit Potential: If correctly identified, breakouts can lead to substantial price movements, offering traders significant profit opportunities.

-

Suitable for Various Timeframes: Whether you're a day trader or prefer longer timeframes, breakout trading can be adapted accordingly.

Challenges and Considerations

-

False Breakouts: As mentioned, the occurrence of false breakouts can lead to losses.

-

Requires Patience: Sometimes, it might take a while for a breakout to materialize, which can test a trader's patience.

-

Over-reliance on Technical Analysis: Solely depending on technical analysis and neglecting fundamental factors can be a mistake. For instance, significant economic news can disrupt technical patterns.

Breakout trading can be combined with other strategies or tools to increase its efficacy. For example, traders might use fundamental analysis to validate a technical breakout or incorporate momentum indicators to gauge the strength of the breakout.

Breakout trading in the Forex market offers traders a structured approach to capture significant price movements. While the strategy holds substantial profit potential, traders should be wary of false breakouts and ensure they combine technical analysis with other tools and remain patient. As with any trading strategy, it's crucial to practice good risk management and continuously educate oneself, adapting to the ever-evolving Forex landscape.

Related Materials

The concept of hedging may conjure images of meticulous garden maintenance, but in the financial landscape, it represents a pivotal strategy for safeguarding investments.

Navigating the intricacies of forex trading can often feel like navigating a labyrinth for beginners. The key to unlocking success within this maze lies in equipping oneself with robust forex trading strategies and techniques. As you venture into the world's largest financial market, having a reliable roadmap in the form of a trading strategy can be a game-changer.

Forex trading, with its high liquidity and rapid price movements, offers traders numerous opportunities. However, it is crucial to have the right strategy to harness these opportunities effectively. Here, we explore the top 5 most profitable forex trading strategies, delving into their advantages and disadvantages...

The anatomy of swing forex trading is deeply rooted in technical analysis. Forex swing traders employ a myriad of tools candlestick patterns, moving averages, momentum indicators like the RSI or MACD, and Fibonacci retracement levels to decipher potential entry and exit points.

Scalping is a popular and fast-paced trading strategy used primarily in the Forex market. The primary objective for scalpers is to capture small price movements with the intention of securing quick profits...

The Trend Following strategy is a widely practiced approach in the world of Forex trading. At its core, the philosophy behind it is simple: Markets tend to move in trends, and the goal is to capture profits from these movements. Traders adopting this strategy will aim to enter the market in the direction of the prevailing trend, seeking to ride the momentum for as long as the trend lasts.

In the vast tapestry of Forex trading methodologies, position trading occupies a distinct niche. Rather than riding the short-term waves and troughs, position traders set their sights on the long-term, capitalizing on extended market movements...

Trusted Forex Brokers

| Broker | Review | Rating | |

|---|---|---|---|

| 1 | HF Markets | ||

| 2 | NordFX | ||

| 3 | Octa | ||

| 4 | FXCM | ||

| 5 | Interactive Brokers | ||

| 6 | ActivTrades | ||

| 7 | FXTM | ||

| 8 | easyMarkets | ||

| 9 | HYCM | ||

| 10 | SaxoBank | ||

| 11 | FxPro | ||

| 12 | Moneta Markets | ||

| 13 | XM | ||

| 14 | FOREX.com | ||

| 15 | Admirals | ||

| 16 | eToro | ||

| 17 | FIBO Group | ||

| 18 | Pepperstone | ||

| 19 | PrimeXBT | ||

| 20 | IronFX | ||

| 21 | Forex4you | ||

| 22 | InstaForex | ||

| 23 | INGOT Brokers | ||

| 24 | Swissquote Bank | ||

| 25 | Oanda |