At its core, scalping is a trading strategy aimed at capturing small price fluctuations in the market, leveraging these minor changes for potentially significant cumulative gains. Imagine a trader skimming off small profits numerous times a day, and you have the essence of a scalper. Scalping involves opening trades for a very short duration, ranging from a few seconds to a few minutes. The main objective isn't to catch large trends or ride long waves, but to exploit tiny, often fleeting market inefficiencies. A successful scalper might only aim for a few pips in profit from each trade, but when executed correctly and frequently, these can compound into substantial daily returns. Scalping is a popular and fast-paced trading strategy used primarily in the Forex market. The primary objective for scalpers is to capture small price movements with the intention of securing quick profits. Due to its nature, scalping typically involves many trades within a single day, with each trade lasting from a few seconds to a few minutes.

How Scalping Forex Strategy Works

- Quick Decisions: Scalpers look for quick market moves and jump in to capture a few pips at a time. The idea is that small, frequent profits can compound over the day.

- Tight Stop-Losses: Given the minimal profit margins on each trade, scalpers typically employ tight stop-losses to ensure that losses, if any, are equally minimal.

- Leverage: Often, scalpers use higher leverage to maximize returns on these small movements. While this can increase profits, it also amplifies risks.

Key Tools and Indicators

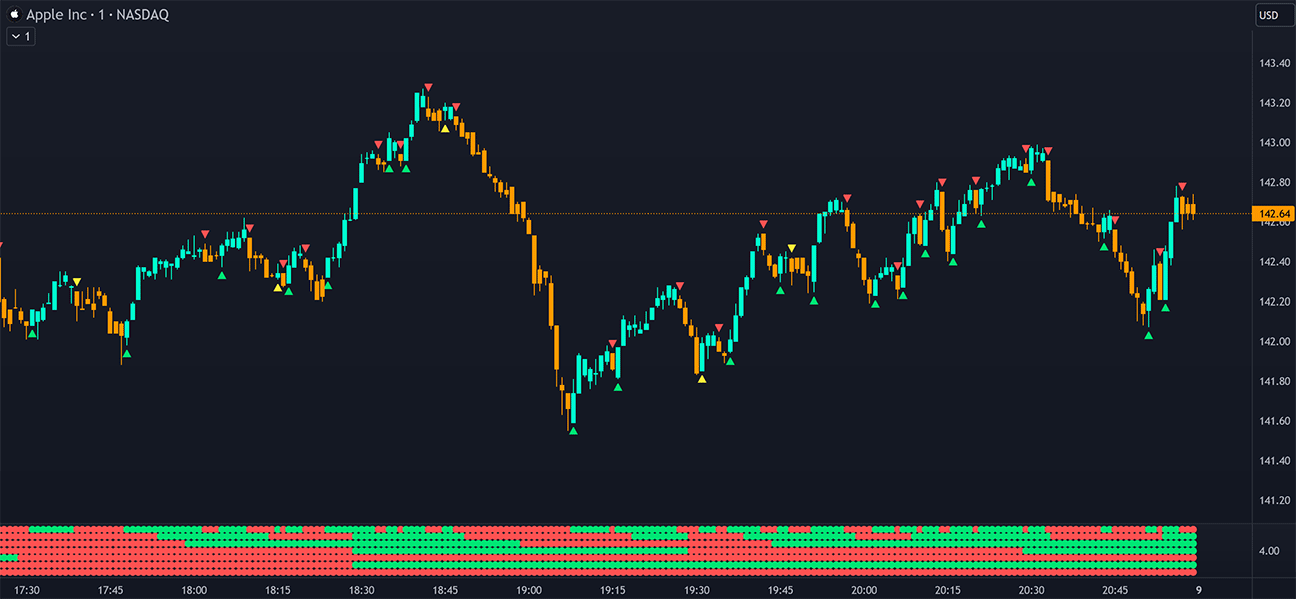

- Timeframes: Scalpers primarily operate on shorter timeframes, typically using 1-minute to 15-minute charts.

- Support and Resistance Levels: These provide potential entry and exit points.

- Moving Averages: A short-term MA (like a 5-period) can be used to identify quick shifts in momentum.

- Stochastic Oscillator: Helps in identifying overbought and oversold conditions.

- Bollinger Bands: They can indicate the volatility and provide levels where the price might bounce or reverse.

Scalping Indicator

Advantages

- Frequent Opportunities: The Forex market is highly liquid, providing numerous scalping opportunities throughout the trading day.

- Limited Exposure: Since positions are held for a very short period, scalpers reduce the risk associated with adverse events impacting their trades overnight.

- Compounding: Small profits can add up quickly, especially when multiple successful trades are executed in one day.

Disadvantages

- Stressful: The rapid pace of scalping can be psychologically taxing. It requires constant attention to the market.

- Broker Dependency: Spreads and commissions become significant when trading frequently. Not all brokers are scalping-friendly.

- Error Proneness: The fast-paced nature can lead to mistakes in order execution.

- Leverage Risks: Using high leverage can result in significant losses if a trade goes against the scalper, even if it's only for a short period.

Tips for Successful Scalping

- Choose the Right Broker: Given the importance of spreads and commissions in scalping, it's crucial to select a broker that offers competitive rates.

- Stay Informed: Keep abreast of economic news and events. Scalping during high-impact news events can be risky due to sudden volatility spikes.

- Automate: Many scalpers use algorithmic trading strategies or trading bots to execute trades quickly and efficiently.

- Stay Disciplined: Quick profits can lead to overconfidence. Always stick to your trading plan and risk management strategy.

Scalping is a unique and challenging trading strategy that demands attention, speed, and discipline. While the allure of quick profits is strong, the risks are equally present. Traders considering scalping should practice extensively on demo accounts, understand the associated costs, and be prepared for the psychological demands of such rapid-fire trading.

The attraction of scalping is multifaceted. Firstly, it offers the potential for consistent daily returns. Unlike longer-term strategies that may require traders to wait days or weeks to realize gains, scalping can provide instant feedback and gratification. This immediacy is appealing, especially to those who are new to the trading world and eager to see results. Moreover, the idea of accumulating profits from small market movements, which might seem insignificant in isolation, becomes compelling when done repeatedly throughout the day.

However, with such rapid trades, the margin for error is exceedingly thin. A scalper doesn't have the luxury of waiting for a trade to possibly turn favorable. Their decision-making is in real-time, and their reactions must be swift and precise. This demand for speed is where technical tools come into play. Scalpers often lean heavily on indicators that can provide immediate signals—be it Moving Averages for quick trend insights or oscillators like the RSI to gauge momentary overbought or oversold conditions.

Another intriguing aspect of scalping is its democratizing potential. While institutional traders with deep pockets and algorithmic trading systems undoubtedly engage in scalping, the strategy is also accessible to individual traders. With the proliferation of online trading platforms and the availability of high leverage, even those with modest capital can try their hand at scalping, seeking to carve out profits from the vast $6 trillion-a-day Forex market. But this democratization also comes with risks. The allure of quick profits can blind traders to the inherent dangers. High-frequency trading means not just multiple opportunities for profit but also multiple chances for losses. Transaction costs, which might seem negligible per trade, can accumulate swiftly. And the emotional toll of such rapid trading cannot be understated; the adrenaline rush of a successful trade is often closely followed by the anxiety of a losing one.

In the expansive world of investments, scalping stands out as a strategy focusing on marginal gains from short-term fluctuations in prices. Especially prevalent in the forex market, let's delve deep into the intricacies of forex scalping. Scalping, in essence, is about capturing small price differences frequently throughout a trading day. In the currency trading landscape, it translates to buying or selling currency pairs based on real-time analytics, holding the position momentarily, and liquidating it for minor gains.

The underlying foundation for scalping is technical analysis, a method involving charting tools that relay multiple signals. A consensus among these signals typically triggers a trading decision.

Forex scalping is a high-frequency trading strategy that targets minuscule profit margins through short-term trades, typically lasting only minutes or seconds. Scalpers leverage "micro trends" to profit from even the smallest of market movements. It's a strategy requiring agility, discipline, and precision. Unlike day traders who might maintain positions for hours, scalpers make trades within minutes. Their goal is to capture small price changes. Position traders, on the other hand, maintain long-term positions, relying on broad market trends for profit. A quintessential scalper seeks numerous trades, aiming for minor profits each time, akin to a fisherman trying to catch small fish in a vast ocean.

The Dynamics of Forex Scalping

While day traders might hold positions for hours, scalpers operate in minutes or even seconds. Day traders might operate on longer time frames like 30-minute charts, but scalpers usually rely on tick charts or one-minute charts. Many advanced scalpers target moments post-economic data releases, leveraging the high volatility that accompanies announcements such as GDP or employment statistics.

Given that a "pip" signifies the smallest price movement in a currency pair, scalpers aim for gains between five and ten pips. With considerable leverage, these small profits can aggregate into substantial sums. For instance, a profit of five pips on one standard lot equates to $50; achieving this ten times a day can lead to gains of $500.

The Scalper's Psyche

Scalping isn't for the faint-hearted. It demands focus, agility, and a penchant for high-risk, high-reward scenarios. Scalpers thrive on the adrenaline of watching the market incessantly and making lightning-fast decisions. Hesitation, over-analysis, or distractions can significantly impact profitability. A key attribute for a scalper is decisiveness—knowing when to enter or exit, especially if the market deviates by a few pips.

Distinguishing Between Market-Making and Scalping

Market-making and scalping might appear analogous, but the distinction is pivotal. Market makers aim to capitalize on spreads, purchasing and then promptly offsetting positions. Scalpers, conversely, pay the spread and depend on price movements to cover these costs. Thus, from a risk perspective, market makers have an edge, making consistent profits from spreads paid by scalpers.

Setting Up for Scalping Success

- Broker Selection: Due to the decentralized nature of the forex market, it's paramount to meticulously choose a broker. Understanding broker agreements, margin requirements, and potential actions during adverse market movements is vital. Thoroughly scrutinize all documentation and be familiar with the fine print.

- Platform Mastery: The broker's trading platform is the scalper's cockpit. Familiarity and ease of use can make or break a trading session. Ensure you practice on the platform to avoid costly errors, like pressing 'Sell' instead of 'Buy'.

- Liquidity: Focusing on highly liquid markets, typically major currency pairs, ensures smoother trading experiences. Trading volumes differ throughout the day, with sessions like London's opening or New York's opening witnessing surges.

- Execution Guarantees: Ensure your broker guarantees order executions at desired levels to prevent "slippage"—the difference between the expected price and the executed price.

- Redundancy: Always have a backup. A fast internet connection, alternative devices, or a direct phone line to the dealing desk can be lifesavers in unforeseen circumstances.

Charting Your Scalping Strategy

- Establishing Direction: Trading in alignment with overarching trends can be advantageous. Utilize weekly and daily charts, embedding trend lines, Fibonacci levels, and moving averages to identify market directions.

- Charting Preparation: Whether you employ manual analysis or automated tools, real-time charts are indispensable for scalping. Set up a 10-minute (for market overview) and a one-minute chart (for trade execution), allowing seamless switching between them.

In conclusion, forex scalping, with its promise of rapid returns, is undeniably enticing. However, like all investment strategies, it demands discipline, diligence, and continual learning. If you have the tenacity and the right tools, scalping could be your gateway to consistent profits in the forex market.

Scalping as a Trading Strategy

The art of scalping is a trading strategy that capitalizes on minor price changes in the market. It's fast-paced, requires quick reflexes, and can be both rewarding and challenging. In this article, we will dive deep into one specific scalping system, discuss the prerequisites for scalping, and touch upon when it's best to scalp and when it's not.

A Closer Look at the RSI Scalping System

One popular trading system for scalping utilizes the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements. In the setup described:

- A three-period RSI is implemented.

- Plot guides are set at 90% and 10%.

- Trading on the short side is initiated once the RSI surpasses the 90% plot guide. Conversely, trading on the long side begins when the RSI dips below the 10% plot guide.

For an enhanced signal accuracy, it's advised to wait for a second crossing into either of these zones. For instance, a trade should be considered only if the RSI enters the specified zone (either 10% or 90%) on two consecutive occasions.

Importance of Practice and Trade Management

Before diving headfirst into this system, it's imperative to test it. This can be done using a demo or practice account, noting down the outcomes of each trade. A crucial realization many traders arrive at is that the key to profitability often lies in managing trades effectively, rather than blind adherence to a system.

It's essential to:

- Limit losses promptly: If the market moves against your position, it's often better to exit early and limit damages.

- Cash in profits judiciously: With scalping, the aim is to achieve seven to 10 pips of profit. This method isn't designed to sustain positions during market retractions.

Efficient trade management, coupled with a robust system, can lead to repetitive success in trading sessions, potentially resulting in substantial returns.

The Psychological Aspects of Scalping

Overanalysis can lead to indecision or "analysis paralysis". Thus, until the method becomes second nature—bordering on monotonous due to repetition—it's important to practice diligently. The goal is clear: profitability. The thrill, the rush of adrenaline, or the casino-like ambiance should not be the focus. Unlike gamblers, professional traders are calculated risk-takers, balancing odds, and emotions.

Strategic Times and Circumstances for Scalping

- Liquidity and Volume: Scalping necessitates quick execution, which is only possible with high liquidity. The major currency pairs during peak trading hours, especially when both the London and New York markets overlap, are ideal.

- Physical and Mental State: Avoid scalping when fatigued or unfocused. Personal conditions, like sleep deprivation or illness, can impair judgment.

- After a Series of Losses: It's essential to pause and recalibrate after consecutive losses. Chasing losses or seeking revenge on the market can lead to compounded mistakes.

- Know Your Personality: Scalping isn't universal. It demands a certain temperament that thrives in a fast-paced environment and can handle quick losses. While scalping offers invaluable lessons and might even lead to other trading styles, it's essential to introspect if it aligns with one's trading persona.

The Value of Record-Keeping

Maintaining a detailed log is paramount. Using screen captures to document trades and subsequently analyzing them not only refines strategies but also offers introspective insights into one's trading habits and behaviors.

Benefits of Scalping in Forex Markets

- Volatility: Forex markets have inherent volatility, providing numerous trading opportunities.

- Liquidity: Forex, being the world's most traded market, guarantees quick trade executions at minimal costs - a vital requirement for scalping.

- 24/7 Market: Forex markets operate round-the-clock, enabling scalping at any time, though certain hours may offer better opportunities.

While scalping can be lucrative, it's not without challenges. The tight profit margins mean that even a small oversight can erase profits from multiple successful trades. Consistent profitability requires an optimal balance of discipline, strategy, and risk management.

Strategies for Forex Scalping

- Breakout Trading: Scalpers identify and trade in the direction of new micro trends until they dissipate.

- High-volume Trading: Trading large volumes to capture profit from minute price movements.

- Spread Trading: Engaging in simultaneous buying and selling to exploit price differentials. This is a complex strategy, often dominated by institutional traders.

- Momentum Trading: This involves capturing small price movements within a broader trend.

A Glimpse into Momentum Trading

- Identify the Larger Trend: Use tools like EMAs to spot overarching trends. Align your trades with this direction.

- Focus on Details: Use shorter-term charts, like 1-minute intervals, to spot detailed price movements.

- Seek Entry Points: Utilize indicators, such as the stochastic oscillator, combined with EMAs to identify potential entry points.

- Define Exit Strategy: Determine in advance your exit points. Close stops and tight profit targets are essential.

While Forex markets are always open, certain hours provide better liquidity and trading conditions. Typically, overlaps between major market sessions, such as New York and London or Tokyo and Sydney, offer the best scalping conditions.

Useful Indicators for Scalping

- RSI: Measures price momentum. A value below 30 suggests oversold conditions, while above 70 indicates overbought.

- Bollinger Bands: Helps identify market volatility and potential overbought or oversold conditions.

- Stochastic Oscillator: Compares an asset’s closing price to its recent price range, providing momentum insights.

- Moving Averages: Useful for spotting impending trends or using MACD for new trading signals.

However, while indicators can aid decisions, many scalpers prioritize price action and look for specific patterns to guide their trades.

To overcome the intense focus and quick decision-making required in scalping, many traders employ automated trading software. However, setting up and maintaining these systems requires consistent monitoring and optimization.

Delving Deep into Forex Scalping: A Comprehensive Guide

Forex scalping, an exciting trading strategy, can offer quick profits if executed correctly. Let's navigate through the intricate nuances of scalping and discern the strategies and best practices for its effective implementation.

Selecting the Optimal Time Frame

Forex scalping is primarily conducted within short time frames. While there's no universally "best" timeframe, scalpers often gravitate towards the 1-minute and 5-minute charts. A 15-minute timeframe, although used, is less common.

Your trade's profit or loss potential correlates with your chosen time frame. For instance:

- 1-minute scalping: Approximate profit target of 5 pips/trade.

- 5-minute scalping: Profit expectation around 10 pips/trade.

Choosing the Right Currency Pairs

A volatile currency pair ensures frequent price movements, making it attractive for scalping. But volatility shouldn't be your sole determinant. Prioritize pairs with minimal spreads to optimize profitability, as spreads can consume 10%-30% of a scalper's income.

Designing a Forex Scalping System

A robust scalping system integrates Forex scalping indicators, streamlining the entry and exit decision process. Efficient stop-loss (SL) and take-profit (TP) management are integral, even though some scalpers may manually manage trades for agility. Remember, in scalping, seconds matter; hence, automated SL or TP can sometimes be counterproductive.

Consider a scenario: EUR/USD spread is 2 pips. Trading 1 lot, a pip's value is USD 10. Thus, upon position opening, you incur a USD 20 expense. For a 5-pip gain/trade (USD 50), you need a 7-pip upward movement. This exemplifies the significance of opting for pairs with tight spreads.

Ensuring Rapid Execution

In the fast-paced world of scalping, trade execution speed is paramount. Fluctuating prices can alter expected trade values. Delayed execution may jeopardize profitability, making broker selection, especially those offering STP or ECN execution, crucial.

Identifying the Ideal Scalping Window

Prime scalping opportunities arise during high volume and liquidity periods. The London (08:00 - 17:00 GMT/BST) and New York (13:00 - 22:00 GMT/BST) sessions stand out. However, strategy variance can make other sessions viable, like the Asian session for trading false breakouts. Mental agility is indispensable, with any cognitive impairment being a scalping deterrent.

The 1 Minute Forex Scalping Strategy

As an entry point for budding scalpers, this strategy focuses on swift position opening and closing to pocket a few pips. Scalpers might execute 100+ trades daily. Here's a basic overview:

- Instruments: Major currency pairs for reduced spreads.

- Time frame: 1-minute.

- Indicators: Stochastic Oscillator (5, 3, 3), 50-period & 100-period EMA.

- Sessions: London and New York due to high volatility.

Weighing the Pros and Cons

Every strategy has its merits and challenges. The 1-minute scalping strategy is no exception.

Advantages:

- Limited market exposure, reducing unforeseen risks.

- Small, frequent price movements are exploited.

- Opportunities arise even during stagnant markets.

Disadvantages:

- Requires a substantial deposit.

- Demands sharp reflexes, analytical prowess, and mathematical acumen.

- Maintaining a favorable risk-reward ratio can be challenging.

- Time-intensive and potentially stressful.

In conclusion, Forex scalping is an intensive, fast-paced trading strategy that can yield rapid rewards for those who master its intricacies. Whether it's right for you depends on your trading style, risk appetite, and personal preferences. Always ensure you are well-informed, prepared, and, most importantly, practice before diving deep into the world of scalping.

Expert Tips for Successful Scalping

- Always Use Stops and Limits: These tools prevent holding onto losing trades for too long, which can be detrimental when scalping.

- Adhere to the 1% Rule: Never risk more than 1% of your total capital on a single trade.

- Plan Ahead: Establish a comprehensive trading plan to maintain discipline and navigate the rapid trading environment of scalping.

Forex scalping, while potentially profitable, demands dedication, quick thinking, and a structured approach. With the right tools, strategies, and mindset, traders can harness the fast-paced nature of the forex market for consistent gains. However, as with any trading style, there's no one-size-fits-all strategy. Continuous learning and adaptation are the keys to success. The forex market, with its vastness and liquidity, is fertile ground for technical analysis-driven strategies like scalping.

However, the scalper usually requires a substantial deposit due to the leverage necessary to make minuscule trades profitable. If the thrill of chasing quick profits by focusing on minute charts excites you, and if you possess the mettle to accept rapid, small losses, scalping might be your game. However, those who prefer a more analytical and contemplative approach might find other trading styles more suitable.

Guide to Selecting Your Forex Scalping Broker

Forex scalping, with its allure of quick profits, necessitates the right broker to ensure efficiency and profitability. Yet, selecting a broker that complements your scalping strategy can be challenging, given the myriad of options available. This guide dives deeper into the essentials of choosing a forex scalping broker.

Interestingly, not all brokers accommodate scalpers. Some brokers have policies preventing traders from closing trades within a brief period, often less than three minutes. For a scalper, such constraints are restrictive. Therefore, the primary step in broker selection is ruling out those who don't support scalping techniques.

Earlier, we highlighted the importance of STP (Straight Through Processing) and ECN (Electronic Communication Network) execution systems. Avoid brokers reliant solely on dealing desks, as this can stifle your scalping capabilities, leading to delays and potential losses.

Assessing Broker Pricing & Offered Instruments

Upon narrowing your list, it's essential to evaluate the instruments provided and their associated costs. Though many brokers impose commissions, they shouldn't deter you. Rather, integrate these commissions into your financial calculations to ascertain the most cost-effective broker. However, costs shouldn't be your sole consideration. Weigh other vital aspects of the broker's offering to ensure they align with your scalping objectives.

Key Broker Selection Criteria

Identifying a dependable broker is imperative, transcending scalping to encompass all trading styles. Here are indispensable factors to guide your decision:

- Competitive Spreads & Costs: Opt for brokers offering competitive pricing to maximize profitability.

- High-Speed Execution: Scalping demands real-time execution; ensure your broker can offer that.

- Order Execution Quality: Determine the reliability and accuracy of order placements and completions.

- Regulatory Oversight: Prioritize brokers overseen by recognized financial regulatory bodies, such as the FCA (Financial Conduct Authority), ensuring credibility and security.

- Fund Security: Confirm the broker's funds are safeguarded with reputable banks to ensure your capital's safety.

Additional Features to Seek

Using a renowned broker as an example, here are extra benefits worth considering:

- Ultra-competitive spreads, starting from 0 pips for major Forex pairs.

- Market execution devoid of re-quotes.

- Minimal slippage and order rejection rates.

- Deep liquidity sourced from top-tier providers.

- Blazing-fast execution speeds, as low as 4 milliseconds.

- Advanced trading tools and versatile platform options.

- Regular educational content, including webinars.

- In-depth financial market analyses.

Execution: An Underestimated Element

Novice scalpers often overlook execution quality, focusing mainly on spreads. Yet, flawless and timely execution is a cornerstone of profitable scalping. To truly gauge a broker's compatibility with your scalping strategy, employ a demo trading account. This hands-on experience offers insights into the broker's operational efficiency and alignment with your scalping aspirations.

In summation, as you venture into the fast-paced world of Forex scalping, aligning with the right broker is paramount. A meticulous broker selection, based on the criteria and features outlined above, lays the foundation for your scalping success.

Top Forex Brokers for Scalping in 2023

Scalping, a high-frequency trading strategy, focuses on realizing profits from minuscule price changes. For scalpers, speed is of the essence. Given the strategy's fast-paced nature, the choice of a forex broker plays an instrumental role in ensuring profitability. We present you with an exhaustive analysis to aid in selecting the finest forex brokers catering to scalpers. This guide factors in the importance of quick trade executions, low fees, and appropriate trading platforms, to name a few.

1. IG - The Superior All-rounder in the U.S. Market

- Multilayered Protections: A fortress of security measures to safeguard trader investments.

- Below-Average Spreads: Minimizing trading costs for scalpers.

- Swift Order Execution: Ensuring scalpers can exploit minute market movements.

- Analysis: A harmonious blend of security, affordability, and speed, IG ensures U.S. scalpers can maneuver through the forex market confidently and cost-effectively.

2. OANDA - Cutting-Edge Trading Tools Connoisseur

- Global Reach: OANDA stands out with its global regulatory adherence, establishing a trustworthy global presence.

- Noteworthy: The trader loyalty program and leading trading tools notably elevate the trading experience, especially for scalpers requiring rapid and analytical tools.

3. Exness - Excellence in Overall Offerings

- Attractions: Boasting raw spread accounts and competitive fees, Exness’s offerings are splendidly aligned with the rapid, cost-sensitive nature of scalping.

- Diverse Markets: A scalper’s playground with access to a broad spectrum of markets.

4. Swissquote - The Beacon of Reliability

- Public Credibility: As a publicly-traded entity and a bank, Swissquote’s transparency and regulatory adherence are paramount.

- Account Diversity: Offering multiple account types, including STP, they cater to varied trader preferences and strategies.

5. Tickmill - A Scalper's Paradise for Trading Platforms

- Platform Arsenal: With MT4, MT5, and more, Tickmill provides an extensive suite of platforms.

- Toolkits: Instruments like Autochartist and an advanced toolkit enhance trading precision and convenience.

6. FxPro - The No-Dealing Desk Maestro

- Transparency and Speed: Ultra-fast execution speeds and high-level transparency place FxPro as a favorite among scalpers despising re-quotes and seeking instant executions.

7. FP Markets - The MT5 Specialist

- Algo Trading: FP Markets not only supports MT5 but also welcomes algo trading.

- Upgradeable MT5: A notable offering is the ability to enhance MT5 with tools like Autochartist, ensuring scalpers have analytical support.

8. IC Markets - Your Ally for Low Spreads

- High-Performance Platforms: Enabling traders to execute trades with minimal latency, critical for scalping success.

- Cost-Effective: The low spreads, especially on raw spread accounts, are notably attractive for scalping.

9. FXOpen - The ECN/STP Account Champion

- Institutional Grade Spreads: Catering to professional and institutional traders with competitive spreads.

- Account Versatility: Offering a selection to cater to varying trader needs and strategies.

10. Admirals - Excelling in Forex Trading

- Extensive Currency Portfolio: With Admirals, traders can venture into Forex & CFDs trading across over 80 currencies. This vast array encompasses Forex majors known for their liquidity, Forex minors that offer diverse opportunities, and exotic currency pairs that cater to the more adventurous trader.

- Up-to-date Market Insights: In the fast-paced world of Forex, staying updated is crucial. Admirals ensures its traders are always ahead of the curve by providing them with the latest technical analysis and trading information. This invaluable data aids in informed decision-making, which is particularly vital for strategies like scalping that rely on minute market movements.

- User-Friendly Interface: One of the defining features of Admirals is its intuitive interface. Whether you're a beginner trying to grasp the basics or a pro aiming to refine your strategies, the platform's design ensures seamless navigation and execution.

- Education & Support: Beyond just trading, Admirals is committed to nurturing its user base. With a wealth of educational content, webinars, and dedicated support, traders can continually hone their skills and resolve any queries efficiently.

Scalping with Assurance: Making the Right Broker Choice

Identifying a broker that synergizes with your scalping strategies is quintessential for success in the rapid, meticulous world of forex scalping. The aforementioned brokers each carry their unique blend of offerings, ensuring that every type of scalper can identify a platform where their strategies can flourish.

Understanding the specifics, from security, market access, fees, and platform options, to additional features, allows scalpers to select a broker that not only permits scalping but actively supports it. Whether prioritizing platform options, trading fees, or trustworthiness, traders can now navigate with confidence through the scalping journey, backed by a broker that comprehensively complements their trade approach and strategy.

Our Selection Criteria: How We Chose the Cream of the Crop

Our methodology involved:

- Scalping Permissibility: Scalping isn't allowed by every broker. We ensured our recommendations are scalping-friendly.

- Account Types: We delved into account types (ECN, DMA, STP, NDD) with low fees tailored for scalping.

- Trading Platforms: We emphasized platforms like MT4, MT5, and cTrader that cater to scalping's rapid dynamics.

- Additional Features: The quality of tools, educational resources, client service, safety standards, and transparency was factored in.

- Deep Analysis: Forex Brokers Organization’s comprehensive methodology was leveraged to dissect each broker's pros and cons.

Decoding Our Methodology

We embarked on an intensive journey to pinpoint the best forex brokers for scalping, scrutinizing over 80 brokers against more than 250 criteria spanning nine crucial categories. Our approach has evolved over time, adapting to industry innovations and regulatory changes. The insights shared are based on real-time experiences — from opening live trading accounts and gauging execution speeds to interacting with genuine customer support representatives. Our nine primary categories encompassed trust, fees, platforms and tools, trading instruments, customer service, fund management (deposits and withdrawals), account variations, research, and education.

For scalping-specific recommendations, we accentuated the broker’s stance on scalping, execution speed, operational model (e.g., STP, ECN, NDD), cost-effectiveness, and the suitability of dedicated scalping platforms. Our results not only identify the industry leaders but also categorize them based on their primary strengths, catering to varied scalping requirements.

For every scalper, the harmony between their strategy and their chosen forex broker is paramount. Our meticulous analysis aims to bridge this gap, ensuring scalpers can seamlessly capitalize on every fleeting market opportunity. Armed with this guide, traders can make informed decisions tailored to their unique scalping strategies.

Related Materials

The concept of hedging may conjure images of meticulous garden maintenance, but in the financial landscape, it represents a pivotal strategy for safeguarding investments.

Navigating the intricacies of forex trading can often feel like navigating a labyrinth for beginners. The key to unlocking success within this maze lies in equipping oneself with robust forex trading strategies and techniques. As you venture into the world's largest financial market, having a reliable roadmap in the form of a trading strategy can be a game-changer.

Forex trading, with its high liquidity and rapid price movements, offers traders numerous opportunities. However, it is crucial to have the right strategy to harness these opportunities effectively. Here, we explore the top 5 most profitable forex trading strategies, delving into their advantages and disadvantages...

The anatomy of swing forex trading is deeply rooted in technical analysis. Forex swing traders employ a myriad of tools candlestick patterns, moving averages, momentum indicators like the RSI or MACD, and Fibonacci retracement levels to decipher potential entry and exit points.

The Trend Following strategy is a widely practiced approach in the world of Forex trading. At its core, the philosophy behind it is simple: Markets tend to move in trends, and the goal is to capture profits from these movements. Traders adopting this strategy will aim to enter the market in the direction of the prevailing trend, seeking to ride the momentum for as long as the trend lasts.

In the vast tapestry of Forex trading methodologies, position trading occupies a distinct niche. Rather than riding the short-term waves and troughs, position traders set their sights on the long-term, capitalizing on extended market movements...

Breakout Trading Strategy capitalizes on moments when an asset breaks beyond established resistance or support levels. This movement could signal the start of significant price movements, and traders aim to enter the market right as the breakout happens, hoping to profit from the subsequent trend...

Trusted Forex Brokers

| Broker | Review | Rating | |

|---|---|---|---|

| 1 | HF Markets | ||

| 2 | NordFX | ||

| 3 | Octa | ||

| 4 | FXCM | ||

| 5 | Interactive Brokers | ||

| 6 | ActivTrades | ||

| 7 | FXTM | ||

| 8 | easyMarkets | ||

| 9 | HYCM | ||

| 10 | SaxoBank | ||

| 11 | FxPro | ||

| 12 | Moneta Markets | ||

| 13 | XM | ||

| 14 | FOREX.com | ||

| 15 | Admirals | ||

| 16 | eToro | ||

| 17 | FIBO Group | ||

| 18 | Pepperstone | ||

| 19 | PrimeXBT | ||

| 20 | IronFX | ||

| 21 | Forex4you | ||

| 22 | InstaForex | ||

| 23 | INGOT Brokers | ||

| 24 | Swissquote Bank | ||

| 25 | Oanda |