In the vast tapestry of Forex trading methodologies, position trading occupies a distinct niche. Rather than riding the short-term waves and troughs, position traders set their sights on the long-term, capitalizing on extended market movements. But what exactly entails position trading, and how does it differentiate from other strategies? This comprehensive review will delve into the nitty-gritty of position trading in the Forex world.

What is Position Trading?

Position trading, in essence, is a strategy where traders hold positions for extended periods – weeks, months, or even years. The primary objective is to benefit from the overarching trends in the market. Unlike day or swing traders, position traders are less concerned with intraday or short-term market fluctuations. Position trading stands out for its long-term perspective and emphasis on comprehensive analysis.

Key Components of Position Trading

-

Fundamental Analysis: Position traders rely heavily on fundamental analysis. They scrutinize macroeconomic indicators, geopolitical events, interest rates, and other significant data points to gauge the overall health of a currency's home country and, subsequently, predict long-term trends.

-

Technical Analysis: While the primary emphasis is on the fundamentals, technical analysis aids in determining entry and exit points.

-

Patience: Given the extended timeframe, patience is more than a virtue in position trading; it's a necessity.

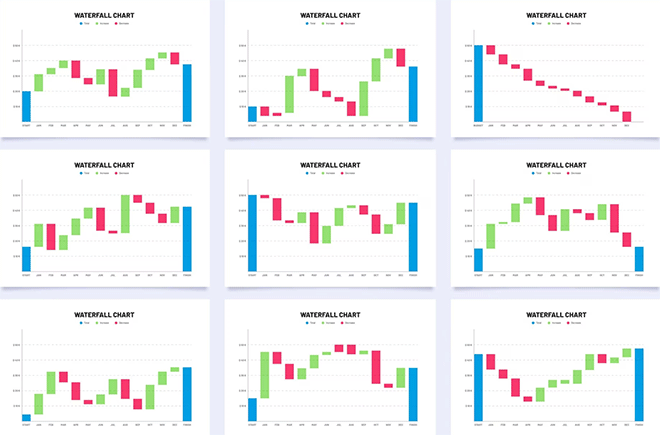

Position Trading Indicators

Advantages of Position Trading

-

Less Stressful: By sidestepping the daily volatility of the market, position traders often experience less stress compared to their day trading counterparts.

-

Lower Transaction Costs: Since positions aren't frequently adjusted, the trading costs, particularly broker commissions, tend to be lower.

-

Comprehensive Research: Extended holding periods mean that decisions are rarely impulsive; they're backed by thorough research and analysis.

Challenges in Position Trading

-

Capital Lockup: Money can be tied up for prolonged periods, potentially missing out on other lucrative opportunities.

-

Larger Stop-Losses: To accommodate market volatility, position traders might have to set broader stop-loss margins.

-

Potential for Significant Drawdowns: Extended market exposure can sometimes lead to substantial unrealized losses before the trend finally turns favorable.

Setting Up a Position Trade

-

Research and Analysis: Delve deep into macroeconomic indicators. Look for economies showing signs of strength or weakness over the long term.

-

Technical Confirmation: Once you're bullish or bearish on a currency, use technical indicators to find a favorable entry point. This might involve identifying support/resistance levels or utilizing tools like moving averages.

-

Risk Management: Determine in advance how much of your portfolio you're willing to risk on the trade. Set stop-losses accordingly, even if they're wider than what you'd use in shorter-term trades.

Exiting a Position Trade

-

Fundamental Shift: If the macroeconomic conditions that prompted your trade change, it might be time to reconsider.

-

Technical Indicators: If long-term technical indicators suggest the trend is reversing, consider exiting or reducing your position.

-

Profit Target Achievement: If your trade reaches a predetermined profit level, you can choose to close it and secure your gains.

While position traders predominantly use fundamental analysis, several technical tools aid their strategy:

-

Moving Averages: Particularly long-term ones like the 200-day moving average.

-

Trend Lines: Drawing trend lines on weekly or monthly charts can help identify long-term trends and potential reversal points.

-

Economic Calendars: These help traders track key events that might influence currency values.

Position Trading vs. Other Strategies

The primary differentiator is the timeframe. Day traders might hold positions for minutes to hours, swing traders for days to weeks, but position traders maintain their trades for weeks, months, or even longer.

Position trading offers a unique lens through which to view the Forex market, emphasizing long-term trends over short-term fluctuations. It demands a deep understanding of fundamental analysis, complemented by the patience to see one's predictions play out.

For those who prefer a more analytical, research-intensive approach and are comfortable with extended market exposure, position trading might just be the strategy to consider. As with all trading methods, success in position trading necessitates continuous learning, adaptability, and sound risk management.

Related Materials

The concept of hedging may conjure images of meticulous garden maintenance, but in the financial landscape, it represents a pivotal strategy for safeguarding investments.

Navigating the intricacies of forex trading can often feel like navigating a labyrinth for beginners. The key to unlocking success within this maze lies in equipping oneself with robust forex trading strategies and techniques. As you venture into the world's largest financial market, having a reliable roadmap in the form of a trading strategy can be a game-changer.

Forex trading, with its high liquidity and rapid price movements, offers traders numerous opportunities. However, it is crucial to have the right strategy to harness these opportunities effectively. Here, we explore the top 5 most profitable forex trading strategies, delving into their advantages and disadvantages...

The anatomy of swing forex trading is deeply rooted in technical analysis. Forex swing traders employ a myriad of tools candlestick patterns, moving averages, momentum indicators like the RSI or MACD, and Fibonacci retracement levels to decipher potential entry and exit points.

Scalping is a popular and fast-paced trading strategy used primarily in the Forex market. The primary objective for scalpers is to capture small price movements with the intention of securing quick profits...

The Trend Following strategy is a widely practiced approach in the world of Forex trading. At its core, the philosophy behind it is simple: Markets tend to move in trends, and the goal is to capture profits from these movements. Traders adopting this strategy will aim to enter the market in the direction of the prevailing trend, seeking to ride the momentum for as long as the trend lasts.

Breakout Trading Strategy capitalizes on moments when an asset breaks beyond established resistance or support levels. This movement could signal the start of significant price movements, and traders aim to enter the market right as the breakout happens, hoping to profit from the subsequent trend...

Trusted Forex Brokers

| Broker | Review | Rating | |

|---|---|---|---|

| 1 | HF Markets | ||

| 2 | NordFX | ||

| 3 | Octa | ||

| 4 | FXCM | ||

| 5 | Interactive Brokers | ||

| 6 | ActivTrades | ||

| 7 | FXTM | ||

| 8 | easyMarkets | ||

| 9 | HYCM | ||

| 10 | SaxoBank | ||

| 11 | FxPro | ||

| 12 | Moneta Markets | ||

| 13 | XM | ||

| 14 | FOREX.com | ||

| 15 | Admirals | ||

| 16 | eToro | ||

| 17 | FIBO Group | ||

| 18 | Pepperstone | ||

| 19 | PrimeXBT | ||

| 20 | IronFX | ||

| 21 | Forex4you | ||

| 22 | InstaForex | ||

| 23 | INGOT Brokers | ||

| 24 | Swissquote Bank | ||

| 25 | Oanda |