The Forex Market Landscape

Renowned for its impressive liquidity and vastness, the forex market dwarfs many other financial markets. With a staggering daily trading volume of around $6.6 trillion – more than double the New York Stock Exchange's turnover – the forex market stands as a tantalizing prospect for budding traders. Its allure lies not only in its size but also in the opportunities it presents for those daring enough to tap into its potential.

However, like any vast territory, the forex landscape has its share of challenges and pitfalls. Embarking on this journey unprepared can lead to costly mistakes. The antidote? A well-defined trading strategy tailor-made to the trader's unique style and objectives.

Deciphering Forex Trading Strategies

At its core, a forex trading strategy is akin to a trader's playbook. It outlines a set of guidelines dictating when to initiate a trade, the best ways to oversee it, and the right moments to exit. These guidelines can range from simple to intricate, reflecting the diversity in traders' preferences and expertise levels.

- Technical Analysis Strategies: Traders who swear by technical analysis rely on historical price charts and various technical indicators to predict future price movements. Such traders have the advantage of clearly defined criteria for entry and exit points, making their trading decisions more black-and-white.

- Fundamental Analysis Strategies: On the other end of the spectrum, traders leaning on fundamental analysis gauge the intrinsic value of currencies. They base their decisions on a plethora of factors like economic indicators, geopolitical events, and central bank decisions. This approach, while offering deeper insights, demands a higher level of discretion and interpretative skills.

Regardless of one's chosen approach, the importance of a well-structured strategy can't be overstated. Not only does it bring method to the madness, but it also provides a consistent framework, helping traders evaluate their performance and refine their techniques over time. Discovering the perfect forex strategy is akin to searching for a needle in a haystack. Few traders have the fortune of stumbling upon their ideal strategy immediately. Instead, most immerse themselves in a period of rigorous exploration, often spanning various techniques and analytical tools.

The Journey to Discovering the Right Strategy

For many, this explorative phase primarily involves extensive backtesting and simulated trading on demo accounts. These platforms offer a sanctuary for traders to experiment without the looming threat of real-world financial consequences. By practicing in such risk-free environments, traders can gauge the effectiveness and viability of different strategies under various market conditions.

However, finding a seemingly successful strategy doesn't signify the end of one's journey. The dynamic nature of the financial markets demands continuous adaptation. Even seasoned traders, equipped with strategies that once yielded impressive returns, often find themselves recalibrating their approaches to align with the ever-shifting market landscape.

Guidance for Novices in the Forex Arena

For newcomers to the forex world, simplicity can be a valuable ally. One of the common pitfalls that many beginners fall into is the allure of intricate strategies. While the array of technical indicators available might seem enticing, attempting to incorporate too many can be counterproductive. This often results in a deluge of information, causing confusion with clashing signals.

Instead, starting with basic, time-tested strategies can provide a solid foundation. As you gain experience and familiarity with the markets, you can gradually refine and evolve your approach. Remember, the insights gleaned from backtesting and demo trading aren't just about identifying profitable techniques; they're also invaluable lessons in understanding market behaviors and refining one's trading instincts.

Choosing the optimal forex strategy is less about finding a one-size-fits-all solution and more about understanding one's own trading style, risk tolerance, and market insights. By starting simple, continuously learning, and being adaptable, traders can navigate the complexities of the forex world with confidence and proficiency.

Delving into Popular Forex Trading Strategies for Novices

Navigating the forex market can be a daunting task, especially for beginners. However, equipped with the right strategies, newcomers can decipher market movements and make informed decisions. Here's an expanded list of some of the most user-friendly and effective forex trading strategies tailored for those just starting:

Price Action Trading

At its core, price action trading is a methodology that relies on discerning decisions from the raw price movements of a particular instrument. It sidesteps the complexity of integrating multiple technical indicators, such as the RSI, MACD, or Bollinger Bands. Instead, this strategy offers several sub-methods - spanning from breakouts, reversals to an array of candlestick patterns.

- Incorporating Technical Indicators: While price action purists might keep technical indicators at bay, some traders lightly sprinkle their strategies with simple tools like moving averages. These additions, though secondary, can aid in trend identification.

- Why Price Action?: The allure of price action trading lies in its minimalist approach. Traders are presented with uncluttered charts, minimizing the risk of information paralysis. Too many indicators can sometimes convolute the decision-making process, particularly for those new to the arena. This direct interaction with the market also sharpens one's intuitive understanding, enabling the recognition of patterns with enhanced efficiency. The approach shines especially bright for day traders. Such traders, aiming to capitalize on brief market fluctuations, benefit from swift decision-making. A decluttered chart, spotlighting pure price action, facilitates this rapid response.

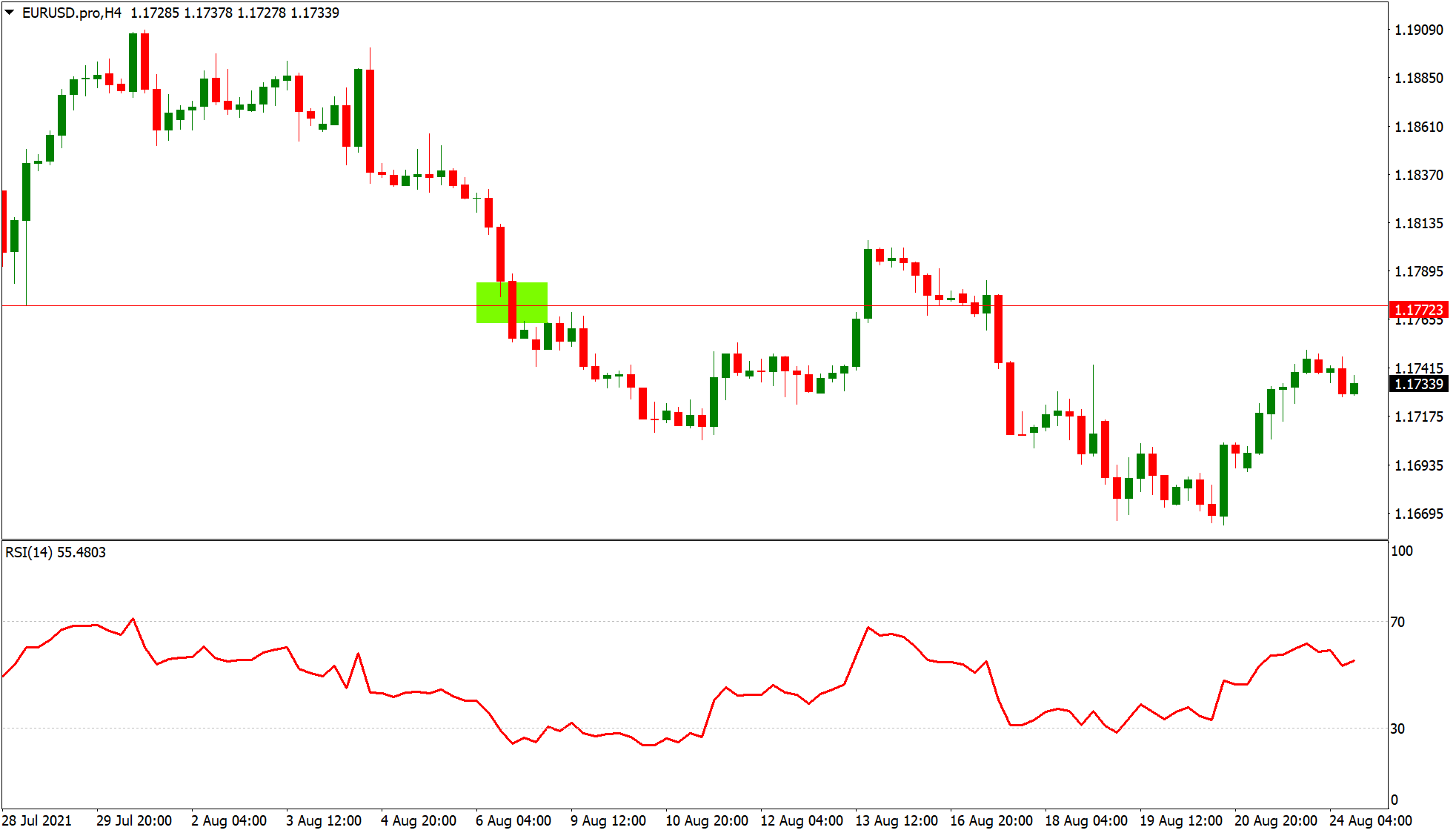

- A Practical Example: Consider the EUR/USD currency pair. Assume 1.1772 stands as a significant support level. A vigilant trader, anticipating a breakout, positions themselves to short EUR/USD, leveraging the imminent decline. Observing the overall trend (a downtrend in this case), it's evident that the currency pair plunges over 70 pips, eventually steadying at 1.1700.

- Strategic Entry Points: Initiation strategies vary among traders. Some might dive in immediately as the price slides below a pivotal support level, possibly even harnessing a sell-stop order. Others, more cautious, might observe the price action a tad longer before making their move. However, it's crucial to be wary of false breakouts, which are not uncommon. A robust risk management framework becomes indispensable in such scenarios.

In essence, price action trading serves as a foundational strategy for many, offering clarity amidst the bustling forex market. It encapsulates the essence of understanding market movements at their purest form, making it an ideal starting point for beginners. As with all strategies, continuous learning, adaptation, and prudent risk management are the keys to long-term success.

Let's delve into which three brokers may be most suitable for Price Action Trading Strategy

- Platform & Tools: Interactive Brokers offers a robust platform with advanced charting tools, perfect for price action traders who rely heavily on charts. Traders can easily spot patterns and make decisions without any lag.

- Cost Efficiency: Known for competitive spreads, this ensures that traders can maximize their returns when trading on smaller price movements, which is often the case in price action trading.

- Reliability: Their reputation in the market is quite strong, having been in the business for decades, which gives traders confidence in their trading decisions.

- Speed & Execution: For Price Action Trading, where traders might enter or exit the market rapidly based on price movements, Pepperstone’s renowned for its lightning-fast execution speeds.

- Platform Choices: They offer both MetaTrader 4 and cTrader, both of which are versatile platforms for price action trading. The ability to customize and use various chart types makes it a favorite.

- Customer Support: Their educational resources and customer support are excellent, which can be crucial for traders who are still getting the hang of price action strategies.

- Advanced Trading Platform: SaxoBank's proprietary platform, SaxoTraderGO, is intuitive and offers sophisticated charting tools, vital for traders looking at pure price patterns.

- Market Access: Given the global nature of price action setups, having access to a multitude of markets is beneficial, and SaxoBank offers a broad range of FX pairs.

- Regulation & Security: Being a heavily regulated bank in Europe, traders can be assured of the safety of their funds.

However, it's crucial to note that the best broker for price action trading strategy (or any other strategy) also depends on individual preferences, such as specific platform features, educational resources, regional restrictions, and more. Always consider doing more recent research and possibly testing with a demo account before making a final decision.

Range Trading Strategy

At the heart of range trading lies the quest for assets that exhibit price movements within a well-defined range. This strategy capitalizes on these price oscillations, leveraging the repeated bounce from the support levels and retracement from the resistance levels.

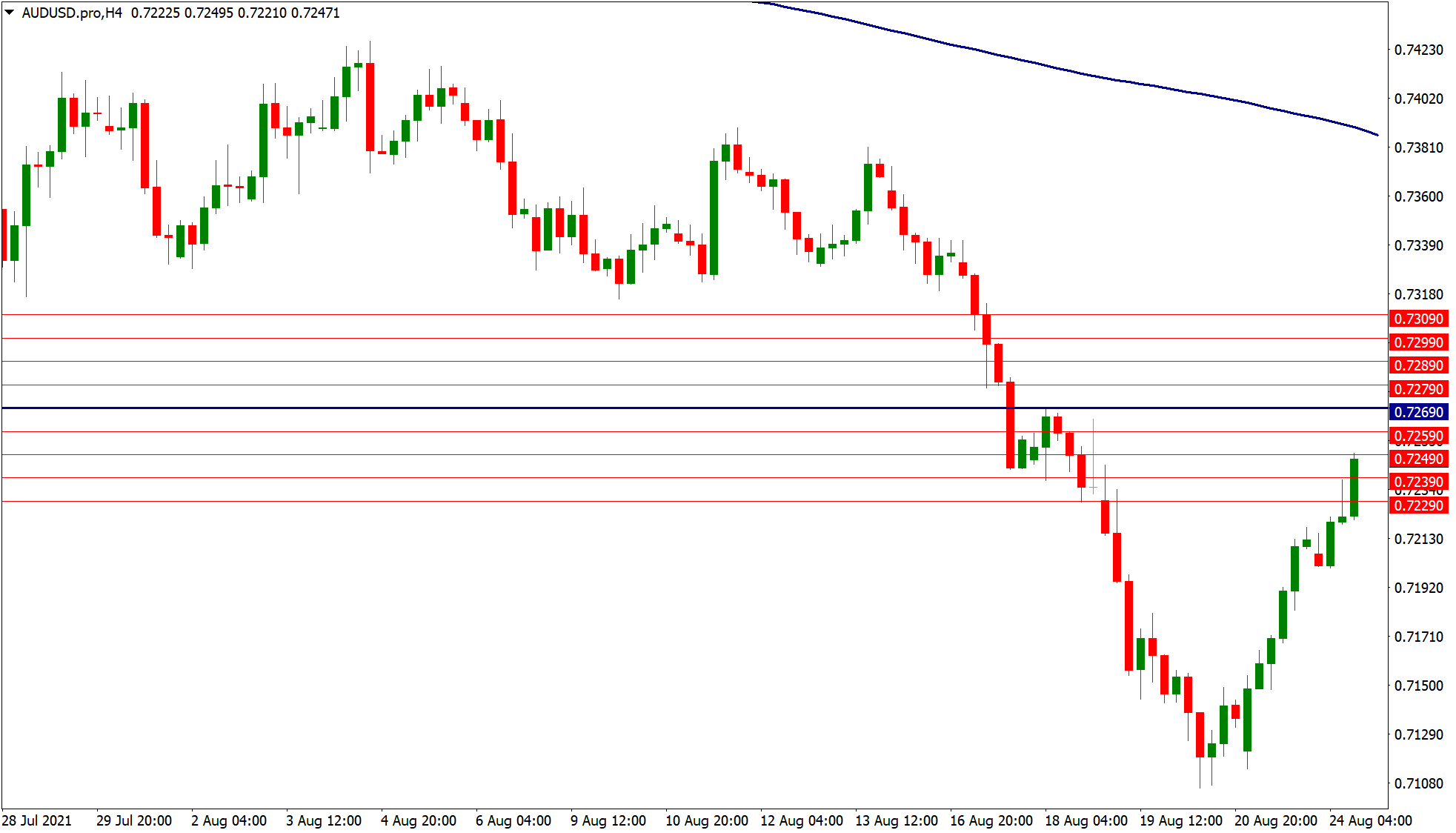

- Scale of Ranges: The scope of these ranges can greatly vary. For a day trader, fluctuations of 20 pips might be of significance. Meanwhile, for a swing or position trader, ranges of several hundred pips might be more pertinent. The essence, however, is the constancy of these support and resistance zones.

- The Art of Spotting Range-bound Instruments: Range trading, by design, thrives in non-trending markets. Identifying such instruments is paramount. While a seasoned eye might discern these through sheer price action observation, novices can employ tools for precision. Indicators like moving averages can delineate the general trend, while the Average Directional Index (ADX) can gauge its strength. An ADX value that's on the lower side typically suggests a feeble trend, making the instrument a potential candidate for range trading.

- Mapping the Consolidation Zone: Upon pinpointing a suitable instrument, the next step involves demarcating its range. This involves identifying the upper and lower boundaries where the price seems to consolidate.

- Strategic Insights: The quintessence of range trading advises buying at the support and selling at the resistance. Yet, the real market often presents a more nuanced picture. Some traders operate within precise levels, while others adopt a more flexible approach, focusing on 'bands' or 'zones'. For instance, if 1.17 emerges as a principal resistance level, but the price tends to stall around 1.1690 or 1.1695, a seasoned trader might earmark the entire zone (1.1690 - 1.17) as a region of interest. Blind adherence to a singular level might mean overlooking lucrative opportunities since prices often reverse just shy of these predetermined points.

- A Practical Illustration: Consider the currency pair EUR/SEK as a case in point. Observing its ADX, we note predominantly low values, indicative of its non-trending nature. On closer inspection, it's evident that the price recurrently rebounds from the 10.00/04 support zone, while consistently facing hurdles at the resistance band stretching between 10.27 and 10.30.

In summary, range trading is a methodical strategy that thrives on predictability. By meticulously observing price movements and equipping oneself with the right tools, traders can effectively harness the ebb and flow of the market, turning potential barriers into profit opportunities.

When selecting brokers for range trading, factors such as low spreads, platform usability, technical analysis tools, customer support, and overall reliability are paramount. Based on these criteria and the provided list of brokers, here are the top three brokers for Range Trading Strategy:

- Platform & Tools: FXCM offers the Trading Station platform, which is equipped with advanced charting features, multiple technical indicators, and automated trading functionalities. This suite of tools is ideal for range traders to identify potential entry and exit points.

- Low Spreads: FXCM is known for its competitive spreads, making it suitable for range trading where frequent trading within a tight range is common.

- Research & Education: They offer comprehensive educational materials and research tools, beneficial for range traders to keep refining their strategy.

- Advanced Charting: Integrated with TradingView, Oanda offers a sophisticated charting package that is crucial for range traders.

- Transparent Pricing: Oanda's pricing model is transparent, ensuring that traders can trust the ranges and price levels depicted on their charts.

- Flexible Trade Sizes: This allows traders to be flexible with their positions, a trait advantageous for range trading.

Admirals (formerly Admiral Markets):

- MetaTrader Suite: With access to both MT4 and MT5 platforms, range traders have a plethora of technical analysis tools and indicators at their disposal.

- Competitive Spreads: Admirals offer tight spreads, especially vital for range trading which involves exploiting small price movements.

- Research & Analysis: Their regular market insights and analysis can assist range traders in making informed decisions.

It's crucial for traders to carry out their own due diligence and perhaps engage with each broker's demo account to ascertain which one aligns best with their range trading objectives. This analysis serves as a guide, and individual requirements may lead to different conclusions.

Trend Trading Strategy

The trend trading approach is anchored in the age-old market adage: "The trend is your friend." At its core, this strategy aims to harness the momentum of a financial instrument by taking positions in the direction of its prevailing trend. It capitalizes on the market's tendency to maintain its directional momentum, be it bullish or bearish.

- Decoding Market Movements: An uptrend is characterized by a market persistently registering higher highs. It embodies the market's bullish sentiment, where the optimism of buyers surpasses the pessimism of sellers. On the contrary, a downtrend, indicated by the market consistently marking lower lows, signals a bearish phase where sellers reign supreme.

- Tools to Track Trends: While the pure price action, marked by the trajectory of candlesticks or bars on a chart, can often offer cues about the market's trend, traders commonly employ additional tools to substantiate their analysis. Among the plethora of tools, moving averages (MAs) hold a revered place.

- Dynamics of Moving Averages: A Moving Average smoothens price data to create a single flowing line, making it easier to identify the direction of the trend. A commonly tracked MA is the 200-day moving average (DMA), which offers a holistic view of an instrument's trend over a considerable period. Whether the price trades above or below this MA can provide insights into bullish or bearish market conditions.

- Moving Average Crossovers: Beyond the singular use of MAs, traders often employ MA crossovers as potential entry or exit signals. Here, two MAs of varying lengths, typically a faster one (like the 50 DMA) and a slower one (such as the 200 DMA), are plotted on the same chart. An upward crossover, where the 50 DMA crosses above the 200 DMA, often hints at an emerging bullish trend. Conversely, a downward crossover, marked by the 50 DMA descending below the 200 DMA, can suggest a potential bearish turn.

- Practical Application: To illustrate, consider the currency pair USD/JPY. By overlaying the pair's chart with the 50 and 200 DMAs, we can discern crossover points. These intersections can serve as crucial junctures where the market might be signaling a shift in its dominant trend, providing traders with valuable entry or exit opportunities.

In conclusion, trend trading amalgamates the inherent momentum of the market with analytical tools to offer traders a structured and potentially profitable trading framework. Being aligned with the market's primary direction often amplifies the probability of success, making trend trading a favored strategy among many.

For trend trading, traders benefit most from brokers that offer advanced charting tools, low spreads, reliable trade execution, and robust technical analysis features. Based on these criteria and the brokers listed, here are the top three suited for Trend Trading Strategy:

- Advanced Trading Platforms: FxPro offers a range of platforms including MT4, MT5, cTrader, and their proprietary FxPro Edge. These platforms provide comprehensive charting and analysis tools essential for trend traders.

- Reliable Execution: FxPro boasts of no dealing desk intervention, which means reliable trade execution without substantial slippages.

- Educational Resources: FxPro also provides a variety of educational materials and webinars which can be advantageous for trend traders.

- Robust Charting Tools: Their platforms, especially the Advanced Trading Platform, offer superior charting capabilities crucial for analyzing trends.

- Extensive Research & Analysis: With insights from in-house analysts and a vast array of market news and technical analysis, trend traders can stay ahead of market movements.

- Reputation: Being one of the largest forex brokers, their trade execution is reliable which is essential for trend traders to capitalize on their strategies.

- Social Trading Platform: eToro’s platform allows users to copy trades from experienced traders, which can be invaluable for those looking to understand trend trading from experienced trend traders.

- User-friendly Interface: Their platform is intuitive with a clear interface, making chart analysis straightforward for spotting trends.

- Diverse Asset Offering: A wide range of assets means trend traders can diversify their strategies across different markets.

It's important to note that broker offerings and tools can evolve over time, so traders should also consider up-to-date reviews and the latest features when making a selection.

Position Trading

Position trading, in essence, is a strategic approach where the trader focuses on the broader canvas of the market, prioritizing long-term trends over fleeting market fluctuations. Contrary to day trading or scalping, where trades are often opened and closed within a single day or even hours, position traders are in it for the long haul. They adopt a panoramic view, often keeping their trades alive for extended durations, spanning weeks, months, or, in exceptional instances, years.

- Position Trading Vs. Other Styles: Unlike scalping, which capitalizes on minuscule price changes, position trading is predicated on capturing significant price movements over time. This makes it an inherently challenging method, demanding a blend of patience, discipline, and a robust analytical aptitude.

- Challenges and Psychological Rigor: The very nature of position trading demands an unwavering commitment to one's trading thesis, even when the market seems to be moving counter-intuitively. This can be a daunting experience, as traders must often endure significant drawdowns or watch potential short-term profits evaporate. Such scenarios test a trader's mettle, requiring them to differentiate between market noise and genuine trend reversals.

- A Practical Illustration: Consider a hypothetical situation from 2018. If, at the onset of the year, a trader held a pessimistic view on the equity market and decided to short the S&P 500, they would be in for a roller-coaster ride. While the early and latter parts of the year might have validated their bearish stance, the robust rally from March to September would have posed a formidable challenge. Such intermediate, contrary price moves necessitate a deep-seated conviction in one's research and analysis. Not many possess the tenacity to weather such storms and stick to their guns.

Position trading, while potentially lucrative due to its focus on substantial trend moves, is not for the faint-hearted. It demands a unique blend of analytical rigor, unwavering patience, and an ability to remain unfazed by short-term market gyrations. Those who master this art often find themselves in an enviable position, reaping the rewards of their steadfastness and market acumen.

Position trading typically involves holding trades for an extended period, ranging from weeks to months, or even longer. Traders using this strategy need brokers that offer low swap or overnight fees, reliable fundamental analysis tools, and a robust trading platform. Based on these requirements and the provided list, here are the top three brokers suited for the Position Trading Strategy:

- Deep Research and Analysis: Swissquote offers a broad range of research materials, including macroeconomic insights and technical analyses, ideal for position traders making longer-term decisions.

- Stability and Security: As a bank and a broker, Swissquote is highly regulated and offers a safe environment for large and long-term deposits.

- Competitive Swaps: For position traders, swap rates can eat into profits, but Swissquote offers competitive rates.

- Educational Resources: FXTM provides an extensive array of educational materials, including webinars, which can be especially beneficial for position traders looking to understand long-term market shifts.

- Economic Calendar: Their detailed economic calendar can help position traders anticipate long-term market movements based on economic events.

- Swap-Free Accounts: FXTM offers Islamic accounts that are swap-free, useful for those who hold trades for extended periods.

- Long-standing Reputation: Having been in the industry for over 40 years, HYCM offers a trustworthy platform for traders looking to maintain positions over extended durations.

- Variety of Account Types: HYCM offers different account types, including a swap-free option which can be crucial for position traders.

- Comprehensive Research Tools: HYCM provides both technical and fundamental analysis, assisting traders in making informed long-term decisions.

Always remember to conduct your own research or consult with a financial advisor before making any decisions, as the trading environment and broker offerings can evolve over time.

Day Trading

At its core, day trading revolves around the principle of capitalizing on short-term market fluctuations within a single trading day. Distinguished from scalping, which operates on a much shorter time frame, day trading occupies a middle ground in the trading spectrum, providing traders with a blend of immediacy and strategic depth.

- Timeframes and Tools: While scalpers might dwell on the granular details of the M1 chart, peering into the market's minute-by-minute movements, day traders generally widen their gaze. They predominantly lean on timeframes ranging from M15 to H1, offering a broader perspective of the market's intraday dynamics. This extended view helps them spot trends, key reversals, and potential breakout points more effectively than the fleeting glimpse an M1 chart offers.

- Volume and Approach: In terms of sheer trade volume, scalpers lead the pack. With their rapid-fire trading style, it's not uncommon for them to initiate more than 10 trades in a day, and in extreme cases, they might breach the 100-trade mark. Day traders, on the other hand, take a more measured approach. Rather than spreading themselves thin over numerous trades, they exercise patience, aiming to pinpoint 2-3 high-quality trade opportunities that promise substantial rewards. This selective strategy allows them to maintain a better risk-reward ratio.

- The Day Trading Mindset: Embracing day trading demands a unique mindset. While it does not entail the frenetic pace of scalping, it still requires quick decision-making skills, an ability to adapt to fast-changing market conditions, and a penchant for thorough analysis. For those who appreciate the adrenaline of intraday trading but desire a buffer from the relentless pressure scalping exudes, day trading presents an ideal alternative. One of its standout advantages is the ability to close positions by the end of the trading session, mitigating potential overnight risks.

Day trading, a dynamic blend of strategy and agility, offers traders the opportunity to capitalize on the ebb and flow of intraday market movements. While it provides the thrill of quick trades, it also affords a touch more breathing room than scalping. For those who seek the middle path between the ultra-short-term hustle of scalping and the extended durations of swing or position trading, day trading emerges as an enticing choice.

Day trading is a strategy where traders open and close positions within the same trading day, capitalizing on intraday market price movements. Key attributes day traders seek in brokers include fast execution speed, low spreads, a stable trading platform, and good research and analysis tools. Based on these requirements and the provided list, here are the top three brokers suited for the Day Trading Strategy:

- Fast Execution: Speed is crucial for day traders, and ActivTrades offers rapid trade execution to ensure traders get in and out of the market efficiently.

- Low Spreads: Day traders are highly sensitive to transaction costs, and ActivTrades is known for its competitive spreads, reducing costs on intraday trades.

- Robust Trading Platforms: Offering both MetaTrader 4 and 5 platforms, traders have access to advanced charting tools and indicators.

- High-Speed Execution: With a large number of liquidity providers, XM offers quick order execution, essential for intraday strategies.

- Zero Account: This account type offers spreads as low as zero, which can be especially beneficial for day traders operating on slim margins.

- Research and Education: XM provides a plethora of webinars, tutorials, and market analyses, allowing day traders to stay updated on market movements.

- Advanced Trading Platform: PrimeXBT's platform is known for its advanced charting tools and customization, allowing day traders to analyze intraday movements effectively.

- Leverage: While it introduces more risk, the broker offers high leverage that can be useful for day traders looking to magnify returns.

- Multiple Markets: Beyond forex, PrimeXBT offers cryptocurrencies, indices, and commodities, giving day traders a wide array of instruments to trade based on intraday news and events.

It's vital for potential users to conduct personal research and perhaps consult with a financial advisor, as broker offerings and trading conditions may change over time.

Scalping Trading Strategy

Scalping, a unique and demanding trading strategy, zeroes in on the nuances of fleeting market fluctuations. With an objective to capitalize on minute price movements, scalpers are akin to sprinters in the vast marathon of trading. Their targets are typically modest, aiming for gains as small as 5 pips per transaction, but when executed consistently, these small gains can accumulate to significant profits.

- Scalper's Toolkit: To succeed in scalping, traders must possess a razor-sharp analytical mindset and an uncanny ability to make split-second decisions. An innate aptitude for numbers and the capability to remain unfazed in high-pressure situations are essential tools in a scalper's repertoire. Since the essence of scalping lies in capturing minuscule price changes, scalpers often tether themselves to their screens, immersing deeply in the data-rich world of one or a few chosen markets. For instance, some might exclusively scalp the EUR/USD pair, while others might dedicate themselves to instruments like the S&P 500 futures.

- Benefits and Challenges of Scalping: One of the standout merits of scalping is the microscopic focus it requires. It narrows down a trader's attention to a specific timeframe, eliminating the complexities of managing long-term positions or deciphering overarching market fundamentals. This laser-sharp focus facilitates a heightened awareness of immediate market dynamics. However, with great potential rewards come substantial challenges. The intensity of scalping requires traders to maintain unwavering concentration throughout their sessions. In such a rapid-fire environment, the margin for error is minuscule. Emotional reactions or even slight hesitations can lead to missed opportunities or losses. The sheer pace and volume of transactions can be mentally exhausting, heightening the risk of mistakes, especially for those new to the realm of scalping.

- A Scalper's Disposition: Given its demanding nature, scalping might not be the ideal starting point for novices in the trading world. But for those with a penchant for fast-paced action, a deep understanding of market mechanics, and the mental fortitude to stay composed under pressure, scalping offers a thrilling and potentially rewarding trading experience.

Scalping is a trading strategy that involves making numerous small trades to profit from minor price fluctuations throughout the day. For scalping to be effective, traders need brokers that offer tight spreads, rapid trade executions, and platforms that can handle high-frequency trading. Based on these criteria and from the list provided, the top three brokers suitable for scalping:

HF Markets, also known as HotForex, is known for its tight spreads, especially on major currency pairs, which is crucial for scalping. They also offer a high-speed execution environment, reducing the risk of slippage, and their MetaTrader platforms are versatile and can handle high-frequency trading.

NordFX provides competitive spreads and a reliable trading platform. Their infrastructure ensures rapid order execution, which is vital for a scalper. Additionally, they offer advanced charting tools that can be beneficial for quick technical analysis.

OctaFX is known for offering even tighter spreads on certain accounts, which can be highly advantageous for scalping. They also boast a robust trading infrastructure that ensures quick trade executions. Their platform is also user-friendly, allowing scalpers to navigate and execute trades efficiently.

It's essential to note that while these brokers may be suitable for scalping based on the criteria mentioned, traders should always conduct their own research and consider factors like withdrawal times, customer service, and regulatory environment before finalizing a broker. Scalping also requires brokers that are understanding and accommodating of the strategy, as not all brokers appreciate the high-frequency trading nature of scalping.

Swing Trading

Swing trading sits at the intersection of quick, intraday trades and long-term position trading, carving a niche for traders who operate on a multi-day to multi-week timeframe. This strategy revolves around capitalizing on price “swings” or market momentum. Depending on their analytical preference, swing traders may utilize charts ranging from an hourly (H1) to a daily (D1) scale, with some even venturing into weekly analyses.

- Strategic Approaches in Swing Trading: Several methodologies fall under the umbrella of swing trading. Trend following involves riding the wave of a discernible market trend until signs indicate its weakening. Range trading, on the other hand, operates within the bounds of a specific price range, buying at perceived lows and selling at perceived highs. Breakout trading, another popular strategy, entails entering the market when the price breaches a previously defined resistance or support level, signaling a possible significant move.

- The Psychological Landscape of Swing Trading: Embarking on the journey of swing trading requires an arsenal of not just technical skills but also a particular psychological mettle. Patience becomes paramount; a trader might sift through charts for days seeking that golden opportunity or grapple with an open position in the red for an extended period. A premature exit, prompted by impatience or fear, could mean missing out on potential profits. The swing trader's mantra, therefore, is discipline and emotional resilience.

- Why Swing Trading Appeals: For those who relish delving deep into market analysis without the pressing immediacy of day trading, swing trading offers a fitting playground. It affords traders the luxury of time, allowing for a more comprehensive market evaluation. This extended window also makes room for fundamental analysis, enabling traders to factor in broader economic, political, or monetary policy shifts. Such in-depth analysis, which could be rendered irrelevant in the fast-paced world of scalping, becomes an asset in the swing trader's toolkit.

Swing trading, with its unique blend of technical and fundamental analysis, provides a holistic approach for those seeking to harness market momentum over extended periods. If you possess the patience to wait for the market's story to unfold and have the discipline to stick to your strategy even in trying times, swing trading might just be your calling in the vast arena of trading styles.

Swing trading is a strategy that attempts to capture gains over a period of several days to several weeks. Swing traders utilize various tactics to find and take advantage of these opportunities, and they require brokers that offer reliable charting tools, fundamental research, and reasonable spreads and fees. Based on these criteria and from the list provided, the top three brokers suitable for swing trading, as of my last training data in January 2022, would be:

FIBO Group is an established broker known for its comprehensive trading tools and platforms, such as MetaTrader 4 and MetaTrader 5. Their platforms provide extensive charting capabilities, making it easier for swing traders to analyze market movements and patterns. The broker also offers a wide range of educational resources, which can be beneficial for refining swing trading strategies.

IronFX provides competitive spreads, which can help in reducing trading costs over the span of several days to weeks. They also offer a strong research section, packed with fundamental analysis and market insights, aiding swing traders in making informed decisions. Their trading platform is robust and offers advanced charting tools crucial for swing trading.

easyMarkets offers innovative trading tools like dealCancellation and Freeze Rate, which can be beneficial for swing traders in managing their trades. The broker also provides a user-friendly platform with an intuitive interface, making it easier for traders to monitor their positions over several days. They also offer insightful market analysis and research, helping swing traders stay updated on market events that might affect their positions.

As always, traders should conduct thorough research and due diligence when choosing a broker. Different swing traders might prioritize different broker features depending on their specific strategies and trading styles.

Carry Trade Strategy

The carry trade strategy is a fascinating approach in the world of foreign exchange trading. Its essence lies in exploiting the interest rate differentials between two distinct currencies in a pair. Rather than solely relying on price movements for profit, this strategy introduces the concept of earning from interest rate variances.

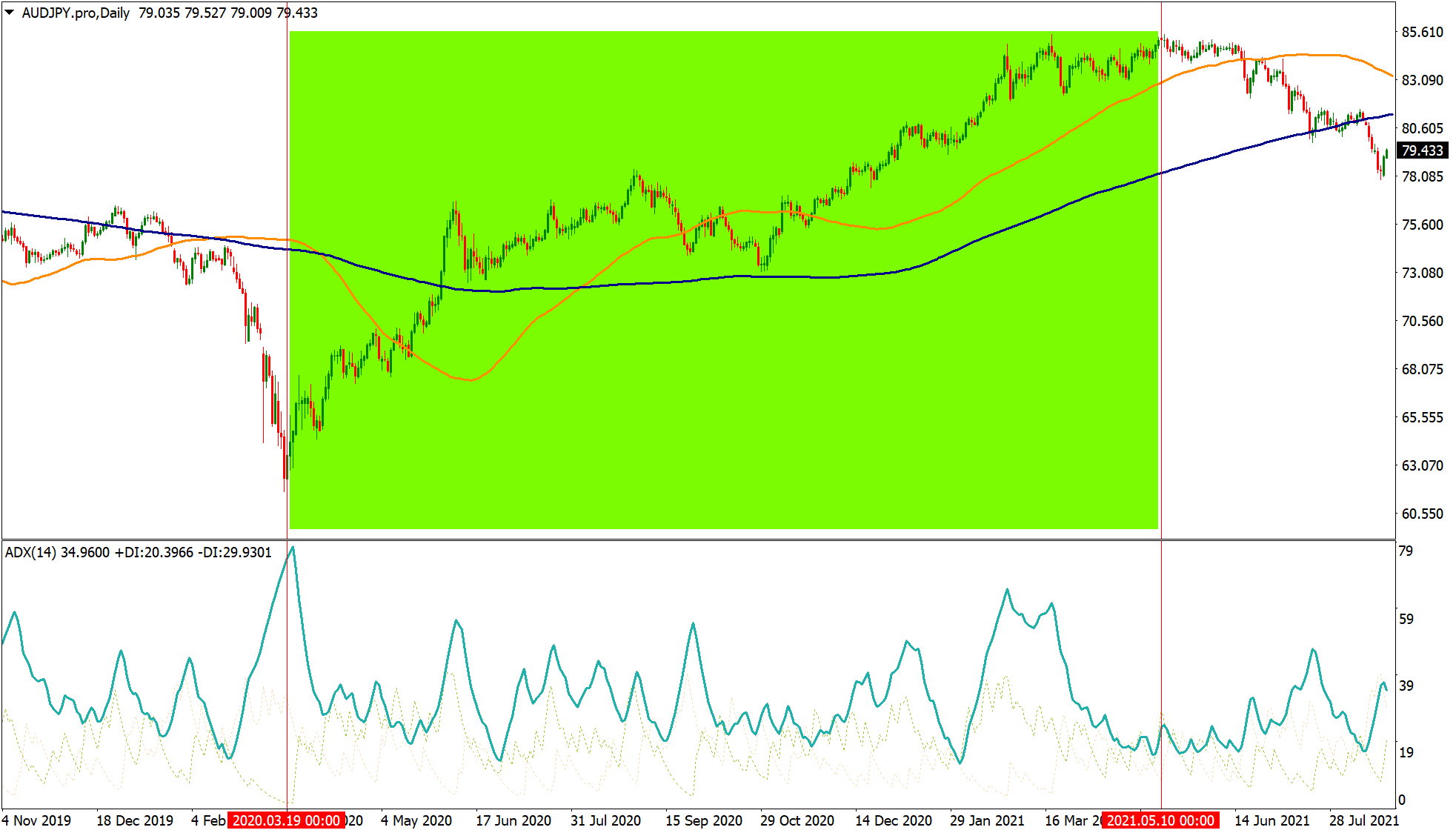

- Mechanics of the Carry Trade: In simple terms, a trader engages in a carry trade by buying a currency that offers a higher interest rate while simultaneously selling a currency with a lower interest rate. The difference or 'carry' can be thought of as the trader's interest earnings. A classic illustration of this strategy is the AUD/JPY pairing. Given Australia's traditionally robust interest rates and Japan's typically low rates, traders often consider going long on AUD/JPY. When executed properly, not only can traders benefit from price appreciation, but they can also accrue interest based on the size of their position.

- Pros and Cons of the Carry Trade: One of the primary attractions of the carry trade is the potential for passive earnings. Simply holding a position can yield significant interest. However, it's crucial to note that market dynamics play a decisive role in the strategy's success. If, for instance, AUD/JPY is witnessing a pronounced downtrend while a trader holds a long position, the accrued interest may not compensate for the resultant negative PnL.

- Optimal Market Conditions for the Carry Trade: Carry trades generally thrive in bullish market scenarios, especially when investors are hungry for risk. Historically, the Japanese Yen is viewed as a "safe-haven" currency, making it a popular choice to sell in carry trade setups. This strategy often pairs the Yen against another currency perceived as "risk-on."

- In-Depth Analysis is Key: Beyond the basic mechanics, a successful carry trader needs a comprehensive understanding of the economic landscapes influencing their chosen currencies. For instance, the Australian Dollar tends to ride the waves of fluctuating commodity prices. Similarly, the Canadian Dollar often moves in tandem with oil price shifts. Thus, being attuned to these correlations can provide traders with an edge.

- Illustrative Example: Consider the AUD/JPY chart. There may be phases distinctly showcasing a bullish trend, indicating a ripe environment for a carry trade. During such periods, traders can potentially benefit from both the interest differential and the currency pair's positive momentum.

The carry trade strategy, while lucrative, demands a deep understanding of global economic factors, interest rates, and currency characteristics. It is a sophisticated blend of passive income generation and active market analysis. For traders equipped with the right knowledge and patience, it can be a potent tool in their trading arsenal.

Carry trade strategies involve taking advantage of the interest rate differential between two currencies. Traders essentially borrow funds in a currency with a lower interest rate and invest in a currency yielding a higher interest rate, profiting from the difference. For a successful carry trade strategy, traders require brokers that provide competitive rollover rates, stability, good leverage, and transparent pricing.

Moneta Markets is known for its straightforward and transparent pricing, which is crucial for carry traders to ensure they are getting the most out of their trades. Additionally, they offer a web-based trading platform that provides an intuitive interface, making it easier for traders to manage and monitor their carry trades. Their advanced tools can help traders assess the potential risks and rewards of different carry trade scenarios.

Forex4you offers competitive leverage, which can amplify the returns on carry trades. Furthermore, they have a reputation for delivering detailed information on overnight swap rates, essential for carry traders to calculate potential returns. Their platform also provides tools for analyzing market conditions and economic calendars, helping traders anticipate events that could impact interest rate differentials.

InstaForex provides traders with a wide range of analytical tools and news resources, helping carry traders make informed decisions based on economic indicators and policies that might affect interest rates. They also have a transparent policy on swap rates, ensuring traders have clarity on potential earnings from their carry trades.

INGOT Brokers is known for its stability and reliability, two essential factors for traders who might hold positions for extended periods, as is common in carry trading. Their platform offers real-time tracking of swap rates, giving carry traders up-to-date information to base their strategies on. Additionally, they provide extensive educational resources that can help traders better understand the nuances of the carry trade strategy.

Traders should note that while carry trading can be profitable, it also comes with its share of risks, particularly from sudden currency movements that can offset the interest gains. As always, it's crucial to thoroughly research and understand any strategy and broker-specific offerings before diving in.

Breakout Strategy

An Introduction to the Breakout Strategy: The breakout strategy stands as one of the most popular and time-tested methodologies within the trading community. It revolves around the principle of recognizing and capitalizing on price movements as they break free from previously defined ranges. At its core, this strategy is a celebration of market momentum and the potential opportunities that arise from sharp price movements.

Every financial instrument tends to oscillate within certain price ranges or 'bands' over specific periods. These price bands or confines are generally determined by established resistance (upper limit) and support (lower limit) levels.

A "breakout" occurs when the price punctures these bounds, indicating a potential for a sustained movement in the breakout direction. Traders adopting the breakout strategy aim to exploit these moments, entering trades in the direction of the breakout to capitalize on the ensuing momentum.

Executing the Breakout Strategy:

- Direct Market Entry: Some traders prefer hands-on management, monitoring price action in real-time. They manually initiate trades the moment they perceive a genuine breakout.

- Use of Stop Orders: A more automated approach involves placing buy-stop orders (for anticipated upward breakouts) or sell-stop orders (for potential downward breakouts). These orders get triggered once the price reaches a predetermined level, ensuring traders don't miss out on potential breakout opportunities even if they aren't monitoring the market in real-time.

- Determining Stop Loss Points: To manage risks, it's crucial to set stop loss points. Typically, after a resistance level is breached in an upward breakout, it becomes the new support. Conversely, a breached support level becomes the new resistance after a downward breakout. Thus, traders usually place stop loss points just below the new support for long trades or just above the new resistance for short trades.

- Setting Profit Targets: When it comes to deciding on exit points, traders can employ classic support and resistance levels. Some also use tools like Fibonacci retracement levels or trendline projections to set potential profit targets.

One essential aspect of the breakout strategy is the need for confirmation. Not every breach of support or resistance signifies a genuine breakout. False breakouts, where the price momentarily crosses a boundary but quickly reverts, are common. Hence, traders often seek additional confirmation through volume analysis, waiting for a certain period post-breakout, or using technical indicators before committing to a trade.

The breakout strategy is both a science and an art. While it offers traders the promise of substantial profits from sharp market moves, it also necessitates a deep understanding of price dynamics, disciplined risk management, and the ability to differentiate genuine breakouts from false ones. For those who master its nuances, the breakout strategy can be a powerful tool in the trading repertoire.

The breakout strategy is both a science and an art. While it offers traders the promise of substantial profits from sharp market moves, it also necessitates a deep understanding of price dynamics, disciplined risk management, and the ability to differentiate genuine breakouts from false ones. For those who master its nuances, the breakout strategy can be a powerful tool in the trading repertoire.

News Trading

News trading is a specialized trading strategy that seeks to capitalize on the market fluctuations instigated by significant news events. These events can range from scheduled occurrences, like central bank announcements and economic data releases, to unpredictable happenings, such as geopolitical unrest or natural calamities.

The Dynamics and Risks

Trading on news requires astute observation and agility, as markets often respond turbulently to big news. Several factors to consider include:

- Market Volatility: News events can lead to rapid and drastic price changes.

- Spread Widening: Brokers might increase the spread between the bid and ask prices during news events, which could impact trade profitability.

- Liquidity Issues: Major news often sees thinner liquidity, which can amplify price movements.

- Slippage: This pertains to the discrepancy between the expected price of a trade and the price at which it is executed. In high volatility periods, slippage can be a common occurrence.

Strategizing News Trading:

- Event Selection: Begin by identifying which news event you aim to trade. Different events impact various segments of the market. For instance, while an announcement by the European Central Bank would predominantly affect the Euro, other currencies and markets could see peripheral effects too.

- Currency Pair Selection: Once the event is chosen, the next step is determining which currency pair will be most affected. For instance, if you're anticipating an aggressive stance from the ECB indicating potential rate hikes, pairing the Euro with a traditionally low-yielding currency like the Japanese Yen might be ideal. Hence, trading the EUR/JPY pair could be advantageous.

- Bias vs. Neutral Approach: With Bias: This involves pre-event analysis, forming an educated guess on the market direction based on anticipated news outcomes. Without Bias: Here, the trader remains neutral, aiming to exploit the market movement post-news, irrespective of its direction.

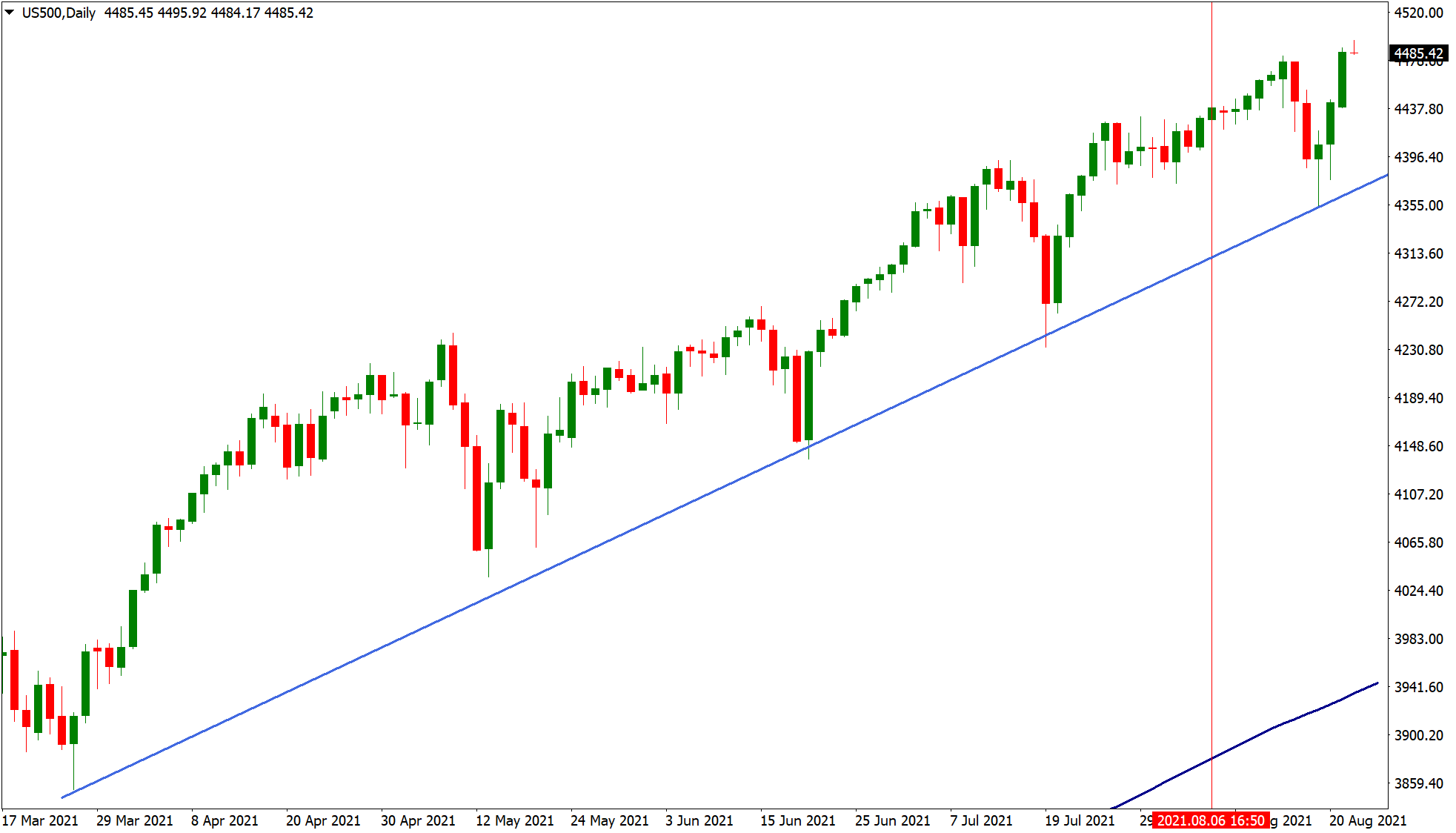

Some traders might opt for a 'straddle strategy', placing both buy and sell orders just before the news, hoping to catch the market move regardless of its direction. Others might wait for the news, analyze the immediate market reaction, and then make their move. To visualize the tangible effects of news on markets, consider the July Non-Farm Payroll (NFP) data release and its consequent impact on the US500 index. Such instances underscore the power and influence of global events on financial markets.

News trading, while offering substantial profit opportunities, is not for the faint-hearted. It demands in-depth market knowledge, a keen understanding of global events, and a robust risk management strategy. Whether you approach it with a bias or choose to remain neutral, staying informed and adaptable is crucial.

Retracement Trading

Retracement trading is a strategy that capitalizes on temporary deviations within a dominant market trend. Unlike reversals, which signify a fundamental shift in the prevailing market direction, retracements are merely short-lived pullbacks or corrections. By engaging in retracement trading, one endeavors to leverage these short-lived price deviations while still aligning with the overarching market trend.

Distinction between Retracements and Reversals

Understanding the distinction between retracements and reversals is pivotal. A retracement is akin to taking a brief respite during a long journey—it's transient and does not change the journey's final destination. A reversal, on the other hand, is akin to changing one's journey altogether. Hence, while trading retracements, it's crucial to ensure you're still sailing with the main current and not against it.

Techniques for Retracement Trading:

- Trendlines: One of the basic tools for retracement trading is using trendlines. These lines, drawn connecting highs or lows, provide visual representations of potential support (in an uptrend) or resistance (in a downtrend) levels. As illustrated in the US500 chart, during an evident uptrend, the ascending trendline could serve as a potential buying zone, especially when prices touch or test this trendline.

- Fibonacci Retracements: This is a more sophisticated approach to retracement trading. Leonardo Fibonacci, a mathematician, introduced a sequence of numbers where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5...). When these numbers are translated into ratios and applied to financial markets, they offer potential retracement levels. The most frequently watched Fibonacci retracement levels in trading are 38.2%, 50%, 61.8%, and 78.6%. These levels often act as psychological barriers where the price could find support or resistance.

Why Retracements Matter

Retracements are intrinsic to market psychology. No asset moves in a straight line; there are always periods of profit-taking or minor sentiment shifts, causing temporary pullbacks. By understanding and leveraging these pullbacks, traders can potentially enter the market at more favorable prices, aligned with the larger trend.

Retracement trading requires a keen eye for detail, patience, and a profound understanding of market mechanics. It's essential to use proper risk management techniques and to differentiate between a genuine retracement and a potential trend reversal. This distinction will play a crucial role in the success of a retracement trading strategy.

Grid Trading

Grid trading is a technique that capitalizes on market volatility through a systematic approach. By setting multiple buy and sell orders at predetermined intervals, traders aim to benefit from price fluctuations, without the need to predict any particular market direction. The essential mechanism involves creating a 'grid' of orders at regular price intervals, both above and below a defined starting price. For instance, if a trader decides to use a 10-pip interval, and the base price is 1.1000, buy orders might be placed at 1.1010, 1.1020, 1.1030, and so on, while sell orders could be set at 1.0990, 1.0980, 1.0970, etc.

As the market fluctuates, these orders get triggered, progressively increasing the trader's exposure. The idea is that for every triggered sell order, there will eventually be a corresponding buy order to profit from and vice versa.

Potential Rewards and Risks

When the market experiences consistent volatility without a clear and sustained trend, grid trading can be exceptionally profitable. As price swings back and forth, orders on both sides of the grid get activated, generating multiple profit opportunities. However, risks manifest when the market decides to trend strongly in one direction. In such scenarios, one side of the grid keeps getting triggered, accumulating a larger and larger position, while the other side remains inactive. If not managed correctly, this can lead to significant losses, especially in cases of unexpected market news or events causing sudden and sharp price movements.

Key Considerations for Grid Trading:

- Setting the Grid: Determine the starting price, the interval size, and the number of orders on each side. Factors like market volatility, the specific asset being traded, and the trader's risk tolerance will influence these decisions.

- Risk Management: It's essential to have a clear exit strategy. Some traders opt to close all positions after a predetermined profit level is reached, while others might use stop-losses to limit potential losses on runaway trends.

- Leverage: Given the nature of grid trading—where positions can accumulate quickly—it's crucial to be cautious with leverage. Overleveraging can amplify both gains and losses.

- Market Analysis: Even though grid trading doesn't rely on predicting market direction, understanding broader market conditions can help set up a more effective grid. For example, during major economic announcements, the grid interval might need to be widened to account for greater volatility.

Grid trading offers an alternative approach to the markets, leveraging the inherent ebb and flow of prices. While it can be a lucrative strategy in the right conditions, it's vital for traders to understand the associated risks and manage their grids with precision and care.

Understanding Personal Trading Edge

Every trader brings a unique set of strengths and weaknesses to the table. This "edge" is essentially the culmination of inherent skills, personality traits, and experiences that dictate their trading style. Some might thrive on the adrenaline rush of intraday trading, quickly deciphering numbers and making split-second decisions. Others, with a more analytical and patient demeanor, might excel in strategies that require a holistic view of the market over extended periods.

Forex trading is not a one-size-fits-all endeavor. While the market remains the same, the way each trader interacts with it varies widely. For novices, it's paramount to recognize these intrinsic attributes and align them with a suitable strategy. Rather than fitting into a mold, the strategy should be an extension of the trader's personality, optimizing their strengths and mitigating weaknesses.

Discovering the Right FX Trading Strategy:

- Demo Testing: Before diving into the deep end, dip your toes in the waters of a demo environment. This risk-free platform, backed by virtual funds, offers a realistic trading experience, helping you gauge which strategy resonates with you.

- Live Testing: Once you've narrowed down a strategy through demo trading, transition to a live environment. This phase tests the strategy's viability in real-world conditions and challenges your adaptability.

- Evolution is Key: Remember, trading is a journey, not a destination. As you garner experience and the market landscape shifts, your strategy might need recalibration. A day trader today could find solace in swing trading tomorrow. Stay flexible and be willing to evolve.

- Leverage Personality Assessments: Numerous online personality tests offer insights into cognitive patterns, decision-making tendencies, and stress-handling capabilities. Taking a few of these can shed light on which trading styles might be more in sync with your nature.

Additional Tips:

- Educate Yourself: While intuition plays a role, knowledge is power. Ensure you are up-to-date with market news, understand economic indicators, and are familiar with technical analysis tools.

- Seek Mentorship: Engage with seasoned traders or join trading communities. Gleaning insights from their experiences can fast-track your learning curve and help you sidestep common pitfalls.

- Consistency Over Quick Wins: While the allure of quick profits is tempting, consistency in generating returns is the hallmark of a successful trader.

Conclusion

Forex strategies are as diverse as the traders who employ them. Recognizing one's individuality and aligning it with the right approach is crucial. While the journey of discovering the perfect strategy might be filled with trials and errors, it's this very process that molds a trader, honing their skills and refining their instincts.

Related Materials

The concept of hedging may conjure images of meticulous garden maintenance, but in the financial landscape, it represents a pivotal strategy for safeguarding investments.

Forex trading, with its high liquidity and rapid price movements, offers traders numerous opportunities. However, it is crucial to have the right strategy to harness these opportunities effectively. Here, we explore the top 5 most profitable forex trading strategies, delving into their advantages and disadvantages...

The anatomy of swing forex trading is deeply rooted in technical analysis. Forex swing traders employ a myriad of tools candlestick patterns, moving averages, momentum indicators like the RSI or MACD, and Fibonacci retracement levels to decipher potential entry and exit points.

Scalping is a popular and fast-paced trading strategy used primarily in the Forex market. The primary objective for scalpers is to capture small price movements with the intention of securing quick profits...

The Trend Following strategy is a widely practiced approach in the world of Forex trading. At its core, the philosophy behind it is simple: Markets tend to move in trends, and the goal is to capture profits from these movements. Traders adopting this strategy will aim to enter the market in the direction of the prevailing trend, seeking to ride the momentum for as long as the trend lasts.

In the vast tapestry of Forex trading methodologies, position trading occupies a distinct niche. Rather than riding the short-term waves and troughs, position traders set their sights on the long-term, capitalizing on extended market movements...

Breakout Trading Strategy capitalizes on moments when an asset breaks beyond established resistance or support levels. This movement could signal the start of significant price movements, and traders aim to enter the market right as the breakout happens, hoping to profit from the subsequent trend...

Trusted Forex Brokers

| Broker | Review | Rating | |

|---|---|---|---|

| 1 | HF Markets | ||

| 2 | NordFX | ||

| 3 | Octa | ||

| 4 | FXCM | ||

| 5 | Interactive Brokers | ||

| 6 | ActivTrades | ||

| 7 | FXTM | ||

| 8 | easyMarkets | ||

| 9 | HYCM | ||

| 10 | SaxoBank | ||

| 11 | FxPro | ||

| 12 | Moneta Markets | ||

| 13 | XM | ||

| 14 | FOREX.com | ||

| 15 | Admirals | ||

| 16 | eToro | ||

| 17 | FIBO Group | ||

| 18 | Pepperstone | ||

| 19 | PrimeXBT | ||

| 20 | IronFX | ||

| 21 | Forex4you | ||

| 22 | InstaForex | ||

| 23 | INGOT Brokers | ||

| 24 | Swissquote Bank | ||

| 25 | Oanda |