Forex Trading Strategies

The Essential Role of Forex Strategies

In the intricate tapestry of financial markets, the foreign exchange (forex) market stands out as the most liquid and vast trading arena. Every day, trillions of dollars change hands as currencies fluctuate against each other, creating opportunities for traders to profit. Yet, like any other venture, navigating the tempestuous waters of forex trading without a compass – in this case, a well-structured trading strategy – can quickly lead to financial shipwreck. This article elucidates why using forex strategies is not just beneficial, but paramount for any serious trader.

Understanding The Nature of Forex Trading Strategies

A strategy provides a structured approach to trading, reducing the role of emotion and impulse, which can often lead to substantial losses. Without a strategy, a trader might end up basing decisions on gut feelings or anecdotal evidence, which is not sustainable in the long run. Moreover, having a plan in place makes it easier to evaluate performance and adjust trading habits accordingly. Traders in the forex market employ a diverse range of strategies to capitalize on currency fluctuations and generate profits. Understanding the nature of these forex strategies is essential for anyone seeking to navigate this intricate landscape. Forex trading strategies vary widely, reflecting the multifaceted nature of the market and the different goals and risk tolerances of traders. These strategies can broadly be categorized into three main groups: fundamental analysis, technical analysis, and sentiment analysis.

Trading Strategy: Your Anchor in a Stormy Market

A robust forex trading strategy serves multiple essential functions:

-

Direction: It provides a systematic approach, offering clear guidelines on when to enter or exit a trade.

-

Emotional Stability: Trading can be emotional, especially during volatile periods. A strategy keeps you grounded, preventing hasty decisions driven by fear or greed.

-

Risk Management: Integral to every strategy is risk management. It defines the amount you're willing to risk per trade, ensuring sustainability even after a series of losses.

-

Consistency: Over time, consistency in application can lead to consistent results. Even if a strategy is only right 60% of the time, applying it consistently can lead to overall profitability.

Without a strategy, any success in the forex market is usually short-lived. It's akin to gambling – you might win occasionally, but over time, the house always has the edge. In trading, the "house" is the collective force of professional traders and institutions using sophisticated strategies and tools. To compete, individual traders must arm themselves with effective strategies.

Diverse Markets Demand Diverse Approaches

The forex market doesn't exhibit the same behavior all the time. There are trending periods, sideways consolidations, and times of high volatility. A well-rounded trader has multiple strategies for various market conditions, ensuring adaptability and continuous opportunity. Markets evolve, and so must trading strategies. Committing to a strategy involves periodic review and refinement. This iterative process not only improves the strategy but also deepens the trader's market understanding and skill set.

Metrics and Analysis

Only by employing a consistent strategy can a trader obtain meaningful metrics about their trading. Win rates, risk-reward ratios, average profitability, and drawdowns are all measurable only when a strategy is consistently applied. These metrics are invaluable for analysis, improvement, and achieving long-term success. In the grand arena of forex trading, where every decision is magnified by leverage and the sheer scale of the market, operating without a strategy is akin to sailing without a compass.

A trading strategy provides direction, instills discipline, mitigates risk, and paves the way for continuous growth and learning. Every seasoned trader knows that success in the forex market isn't the result of random actions but the outcome of informed decisions based on a well-tested strategy.

For those serious about forex trading, developing, testing, and refining trading strategies should be a primary focus. After all, in the world of trading, strategy isn't just important – it's everything. Like all aspects of the financial world, Forex trading strategies evolve. As markets change and new technologies emerge, strategies adapt. For instance, with the advent of advanced analytics and machine learning, some traders have incorporated algorithmic trading to predict price movements better.

The concept of hedging may conjure images of meticulous garden maintenance, but in the financial landscape, it represents a pivotal strategy for safeguarding investments.

Navigating the intricacies of forex trading can often feel like navigating a labyrinth for beginners. The key to unlocking success within this maze lies in equipping oneself with robust forex trading strategies and techniques. As you venture into the world's largest financial market, having a reliable roadmap in the form of a trading strategy can be a game-changer.

Forex trading, with its high liquidity and rapid price movements, offers traders numerous opportunities. However, it is crucial to have the right strategy to harness these opportunities effectively. Here, we explore the top 5 most profitable forex trading strategies, delving into their advantages and disadvantages...

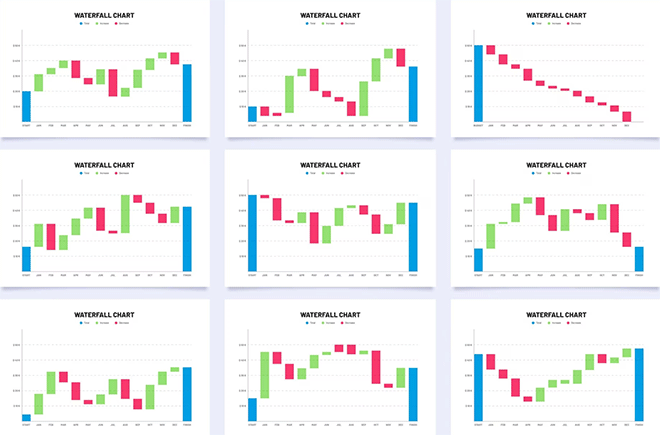

The anatomy of swing forex trading is deeply rooted in technical analysis. Forex swing traders employ a myriad of tools candlestick patterns, moving averages, momentum indicators like the RSI or MACD, and Fibonacci retracement levels to decipher potential entry and exit points.

Scalping is a popular and fast-paced trading strategy used primarily in the Forex market. The primary objective for scalpers is to capture small price movements with the intention of securing quick profits...

The Trend Following strategy is a widely practiced approach in the world of Forex trading. At its core, the philosophy behind it is simple: Markets tend to move in trends, and the goal is to capture profits from these movements. Traders adopting this strategy will aim to enter the market in the direction of the prevailing trend, seeking to ride the momentum for as long as the trend lasts.

In the vast tapestry of Forex trading methodologies, position trading occupies a distinct niche. Rather than riding the short-term waves and troughs, position traders set their sights on the long-term, capitalizing on extended market movements...

Breakout Trading Strategy capitalizes on moments when an asset breaks beyond established resistance or support levels. This movement could signal the start of significant price movements, and traders aim to enter the market right as the breakout happens, hoping to profit from the subsequent trend...